Key Economic and Financial Drivers to Watch in 2023

There is an old joke that the role of economic forecasters is to make astrologers look good. Forecasting GDP or inflation for the upcoming year with any degree of accuracy is virtually impossible, as there are so many chance elements (war, pestilence, famine, etc.). Columnist Les Nemethy believes it is far more important to understand the economic and financial drivers for 2023.

I see a continuation of some of thedrivers I have been discussing invarious articles over the past twoyears, namely:

(a) Stubbornly high inflation, to which

(b) central banks respond by keeping interest rates elevated or raising them further, which in turn

(c) pushes most of the world into a recession (or worse, depression). Finally,

(d) high interest rates and declining GDP growth could strain financial markets.

Let me address each of these in more detail. An additional twist of war (Ukraine, etc.), climate change (hurricanes, etc.), and pestilence (COVID, etc.) may contribute to high volatility.

Stubbornly High Inflation

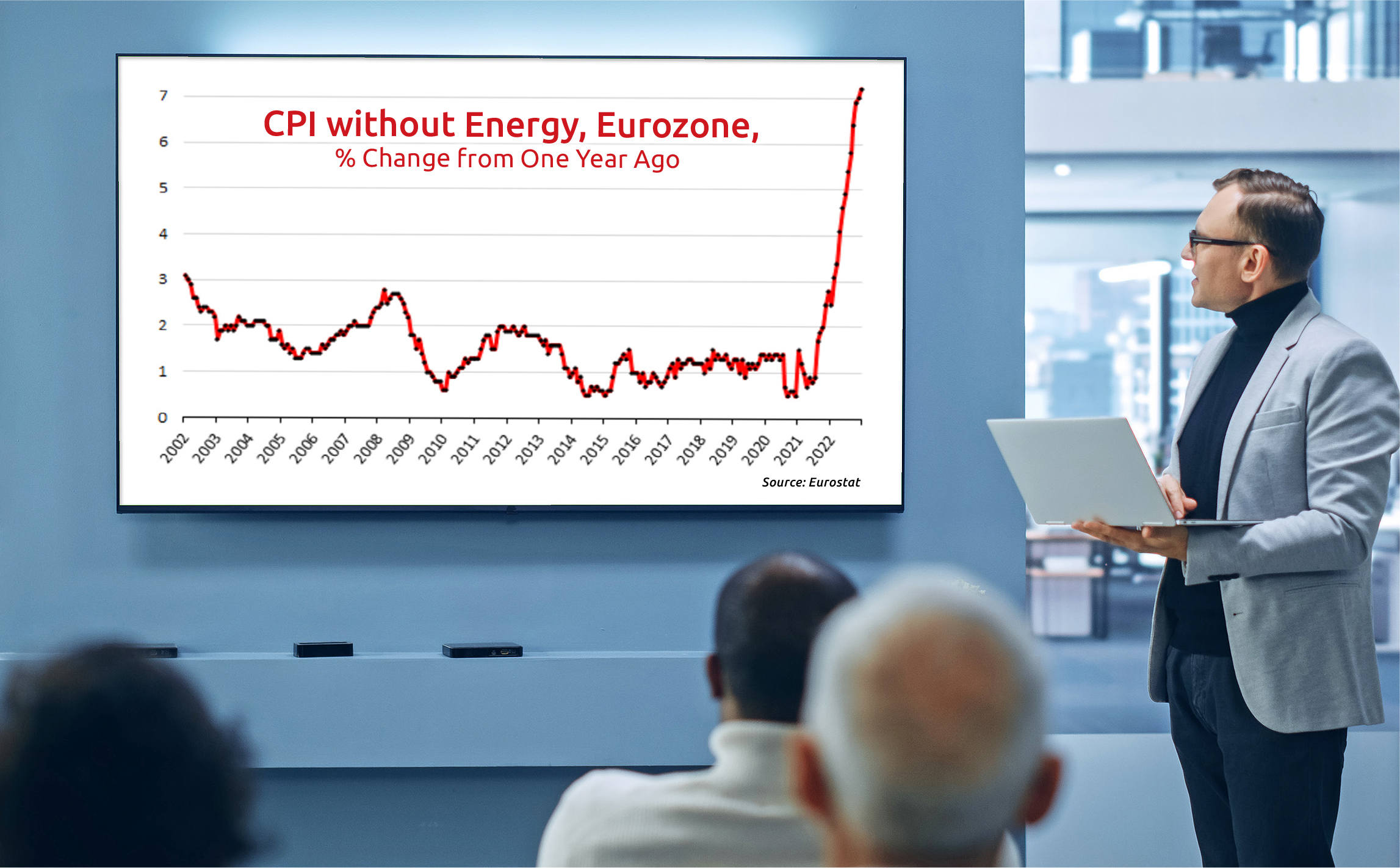

Eurostat has just released some extremely scary inflation numbers. Despite energy prices having moderated in the past months, inflation is going out of control in Europe. Unfavorable demographics, including “the great resignation” (people falling out of the workforce far faster than usual), means that wage pressures are extremely high, which feeds into inflation in services.

We are rapidly approaching the point where inflation expectations become entrenched, possibly further accelerating inflation but almost certainly making it much more difficult to stamp out.

While extreme seasonal warmth inmost of Europe has helped moderate energy prices over the past few months, a severe cold snap could easily swing energy prices in the other direction, further accelerating overall CPI.

Europe is in a particularly hard place with respect to fighting inflation because of exceedingly high debt levels on the periphery (Italy, for example) and high leverage exposure of its major banks, which hold risky government debt as supposedly “safe”assets.

In the United States, a significant impetus to inflation is the labor market situation. Most people think that the recent high number of layoffs should dampen inflation. But there have also been massive numbers of retirements and early retirements; hence, the number of unfilled positions remains high. It is ultimately the inability to fill vacant positions, not the number of layoffs, that drives wage inflation.

The States saw high inflation in 2022 despite a considerable appreciation in the U.S. Dollar, a strong inflation moderating influence. The recent decline in the dollar may now further fuel inflation, particularly if dollar devaluation continues in 2023.

High Interest Rates

The European Central Bank has done too little too late to raise interest rates over the past two years, and the chart shows the result; hence, for the foreseeable future, European interest rates will, by necessity, play “catch-up” and have nowhere to go but up.

In America, the Federal Reserve continues to try to wipe out inflation by squeezing the economy, a strategy of “burning down the house to roast the pig,” as economist Robert Solow calls it.

Or, as Luke Groman says, “Volcker could do what Volcker did because he could break inflation before he broke the Federal Government’s fiscal position. Powell can’t.”

The national debt is several times higher today (close to 130% of GDP) than it was in Volcker’s time (when it was in the range of 30%).

Recession, or Worse

So, the U.S. Fed will likely continue its tight policy until “something breaks” (for example, a failure of the bond markets or pension funds). When that happens, it will revert to Quantitative Easing and even larger fiscal deficits. The scale may need to be so massive that, given the already high debt levels, society’s confidence in fiat currencies may be shaken.

Even before “something breaks,” the world economy is already losing steam. The International Monetary Fund recently warned that a third of the world might be in recession by 2023. It could be higher.

Strain on Financial Markets

2022 saw a very rare scenario. Both U.S. equity and bond markets declined in the order of magnitude of 20%, an annus horribilis for investors, pension funds, etc. U.S. financial markets still seem hopeful for a soft landing. Should it become apparent that is not possible, and corporate earnings reports increasingly miss forecasts, equity markets could see a further collapse.

Now that global debt levels are higher, economic fragility is greater. And, of course, COVID and the war in Ukraine, together with many other pressure points in the world, from Taiwan to the Middle East, tend to increase volatility.

Given such drivers, an optimistic scenario would be that equity markets move horizontally in 2023; but whichever direction they take, it is unlikely to be a straight-line progression. Happy 2023!

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www.businessexitplanningbook.com), and a previous president of the American Chamber ofCommerce in Hungary.

This article was first published in the Budapest Business Journal print issue of January 13, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.