Interactive Brokers Central Europe Eyes Regional Expansion From Budapest

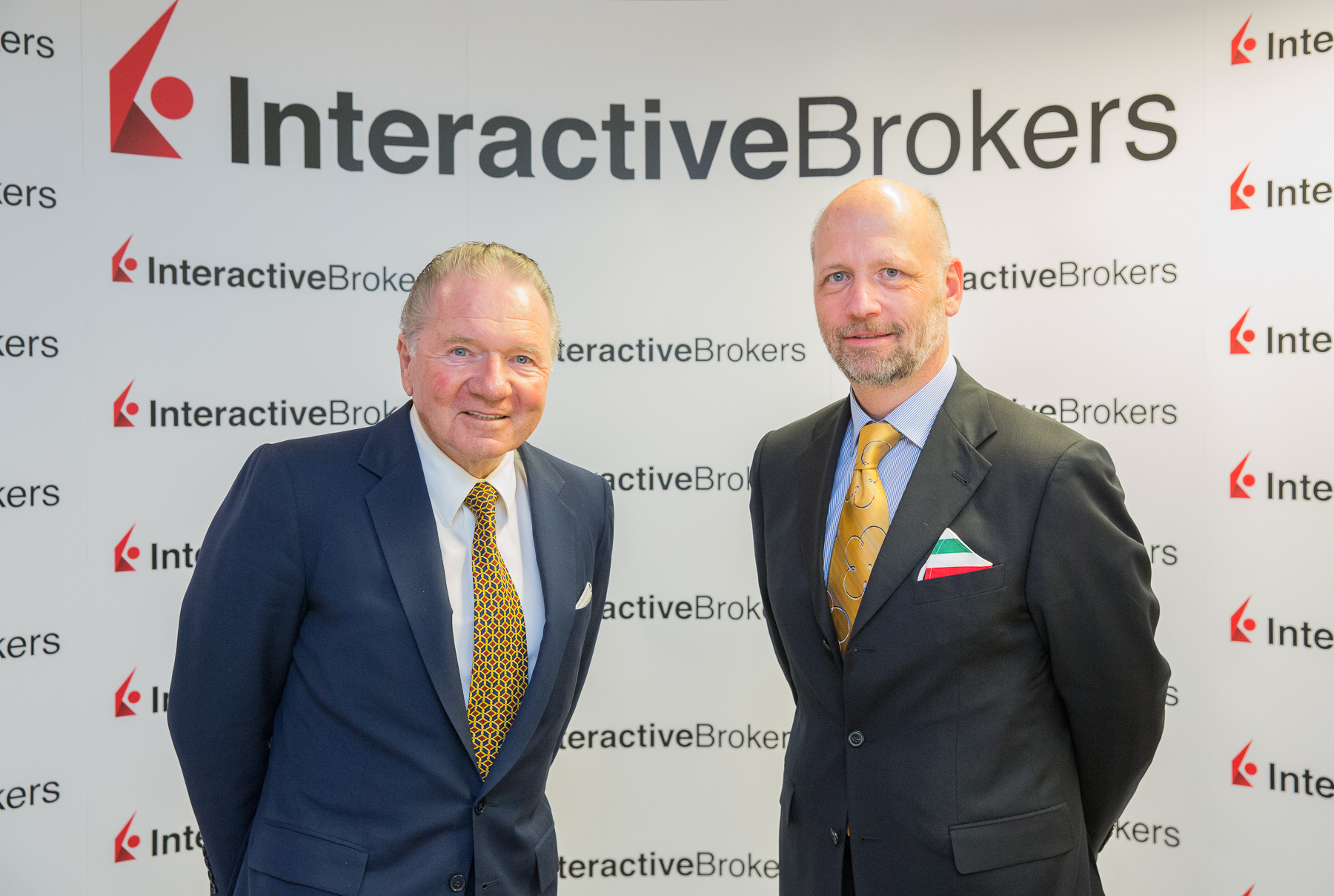

From left, Thomas Peterffy, founding chairman of Interactive Brokers Group, and Miklós Hanti, CEO of Interactive Brokers Central Europe Zrt.

Interactive Brokers eyes rapid growth in terms of clients and staff globally and regionally, founding chairman Thomas Peterffy told reporters at a Budapest press conference.

The broker announced on June 1 that its Hungarian unit had become a member of the Budapest Stock Exchange as part of its strategic plans to expand in Central, Eastern, and Southeastern Europe from its Budapest base. Post-Brexit, the company started serving Western European clients from Ireland and Eastern Europeans from Hungary.

The Hungarian entity, Interactive Brokers Central Europe Zrt. (IBCE), aims to hire some 100 staff initially to serve both Hungarian and regional clients. Interactive Brokers has already been operating a software development subsidiary in Budapest for 13 years with around 50 developers.

“This unit is looking to grow and hire more developers, but it is difficult to find talented people,” Peterffy told reporters.

IBCE has already acquired 20,000 new customer accounts and transferred the investments of 40,000 Central and Eastern European clients with some USD 3 billion in assets to the Hungarian unit.

In 10 to 20 years, Interactive Brokers, which has 1.4 million clients now, wants to reach 80 million clients worldwide, and within that, up to about 1.5 million in this region, Peterffy said. As of November 30, client accounts worldwide had grown 52% from the previous year, with more than 80% of the expansion coming from outside the United States.

Profit Margins

“We are very comfortable because our profit margin is about 65% pre-tax,” Peterffy said. “As volume increases, the profit margin will rise. On the other hand, we have to launch new products to assure that we remain the broker of choice for sophisticated customers and that is going to cost us money. We expect the profit margin to remain over 60%.”

He said that he never really looks at profit margins by geography because Interactive Brokers’ pricing is the same everywhere. The only difference is that the overheads are higher in certain places than in others. In Hungary, the overheads will be roughly the same as in Ireland, relative to the transaction value, and in both countries somewhat more than in the United States.

When asked how he sees the involvement of younger generations in trading and investment, he said that this is a good trend because it makes young people learn how capitalism, the economy, and companies work.

They will also understand how businesses can be evaluated and how their value might change. The pros, Peterffy argues, outweigh the cons, adding that all investments carry risks, especially if the investors have not done their homework beforehand. There is a new emerging trend for attracting younger people after U.S. broker Fidelity Investments launched an account for teenagers in May.

“There is a slight chance that the U.S. dollar and other paper currencies will lose their value,” said Peterffy. “That’s why I thought three or four years ago that everybody should invest less than 1% of their total assets in bitcoin and gold. This is what I did, too, but I think it was stupid because bitcoin is nothing, just a mathematical formula.”

Speaking of market outlook, Peterffy sees prices increasing everywhere and thinks that the stability of the United States is in danger. Central Europe will perform way better than America in the coming three years. As prices are lower than in Western Europe and the States, he sees an excellent possibility for players to invest money in the region.

“We might try to launch new ETFs or revamp the old ones here,” he added.

Peterffy, who emigrated from Hungary to the United States in 1965, said that he had two reasons to open a business in Budapest. It is cheaper to hire Hungarians than Western Europeans, and Hungarians are skilled at computer and software development. A second reason is that he wanted to repay the country because he grew up and received an education here. He says he learned everything he needed to know for a successful career in Hungary.

Interactive Brokers has USD 9.7 bln in equity capital, USD 28 bln in market capital, and some USD 340 bln in client equity. The broker offers clients worldwide the ability to invest in stocks, options, futures, currencies, bonds, and funds on 135 markets in 33 countries from a single integrated investment account.

This article was first published in the Budapest Business Journal print issue of June 4, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.