National Bank’s Inflation Battle Continues Apace

The National Bank of Hungary (MNB) is continuing its fight against rising inflation expectations by maintaining its tightening cycle and also putting an end to its bond purchase program. The inflation rate reached 7.4% in November, and the MNB has significantly raised its inflation forecast for 2022.

The November inflation figure was a 14-year high. The last time the inflation was as high as recorded in November was in December 2007. The highest price rises over the previous 12 months were measured for motor fuels as well as alcoholic beverages and tobacco. In one month, consumer prices increased by 0.7% on average. Food prices were up 6% on a year-on-year basis, of which the highest rise was registered among edible oils (26.9%).

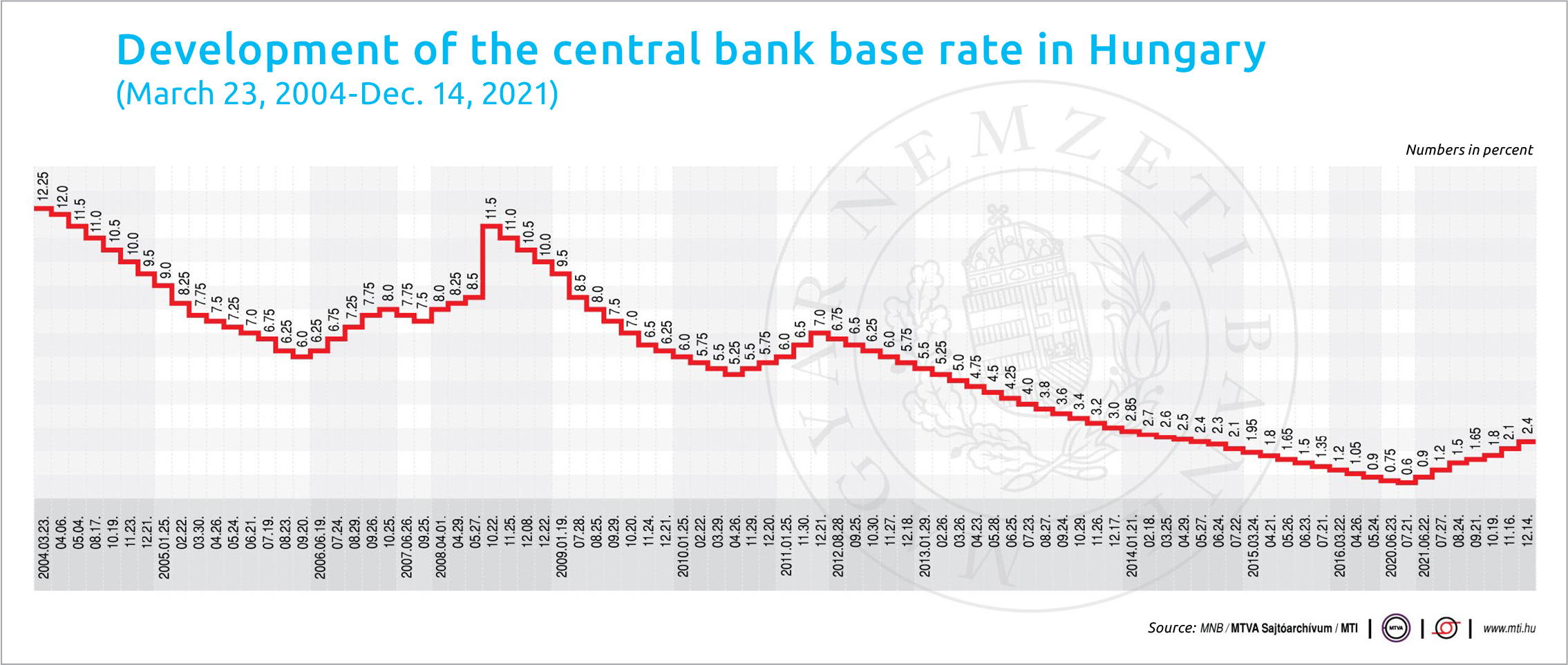

In line with expectations, the MNB has continued its tightening cycle, albeit the pace of the rise is still slower than expected by analysts. On Dec. 14, the Monetary Council decided to raise the base rate by 30 basis points to 2.4%, its highest level since May 2014. It also made it clear it would carry on with further rate hikes next year to anchor rising inflation expectations.

The central bank also raised the rate on its overnight deposit facility by a larger-than-expected 80 basis points to 2.4%. This was a surprise move that the bank said aimed at supporting the stability of swap market rates.

In a move that has been expected for some time now, the MNB ended its bond purchase programs with immediate effect. In a press release following the rate-setting decision, the central bank said that it would closely monitor liquidity developments and be ready to step in with occasional and targeted government securities purchases if necessary.

“Occasional government securities purchases will not indicate a change in the stance of monetary policy,” the MNB emphasized.

The 30 basis points hike was below analysts’ expectations. Gábor Regős, head of the macroeconomics department at Századvég Gazdaságkutató, said that while the rate hike was lower than anticipated, raising the bottom of the interest rate corridor to the level of the base rate (2.4%) was a surprise.

More Significant Tightening

However, the most significant tightening in Tuesday’s decision was the closure of the bank’s asset purchase programs. Hopefully, the cessation of government securities purchases will also mean a tightening of fiscal policy due to a more difficult financing environment, Regős added.

Gergely Suppan of Takarékbank said that natural gas, electricity and oil prices have plummeted since the MNB’s interest rate decision in September, which could lead to significant and widespread inflationary pressures while maintaining household energy prices.

Meanwhile, a tight labor market, coupled with a pick-up in wage dynamics and a higher inflation environment, could lead to a further rise in inflation expectations and a strengthening of second-round inflation risks, he warned.

Regarding the closure of the bond purchasing program, Suppan said that the ample liquidity and robust capitalization of the banking system paired with the improved conditions of the bond market in recent years make market-based financing possible for the corporate sector.

Orsolya Nyeste, the chief economist at Erste Bank, said that MNB communications suggest further interest rate hikes; short-term effective interest rates could be well above 4% in the near future, she noted.

K&H Bank chief analyst Dávid Németh pointed out that the central bank has now pushed up and narrowed the interest rate band, raising the deposit rate by 80 basis points, while the other end of the band and the lending rate went up by 30 basis points.

Short-term Interest Rate

With this move, the bank is trying to influence short-term interest rates. Together with its other assets, such as the foreign exchange swap and the short-term bond, it is trying to stabilize the interest rate environment.

According to Németh, the central bank may be expected to raise the interest rate on the one-week deposits, which now plays the role of the key interest rate, further.

“However, the question is whether there will be another tightening in the last two interest rate tenders of the year. We still expect the MNB to raise the one-week deposit rate to a minimum of 4%,” Németh added.

Following the rate-setting meeting, the MNB also released a few cornerstone figures from its Inflation Report published on Dec. 16. As it turns out, the MNB now predicts much higher-than-expected inflation next year. After the 5% inflation rate this year, the bank warns that a similar pace of price increases of 4.7-5.1% may follow in 2022.

There has also been a significant change in GDP growth forecasts. Average annual GDP growth for 2021 could be 6.3-6.5% instead of the 6.5-7% range predicted back in September this year.

This lower growth forecast reflects weaker-than-expected Q3 GDP data and a deterioration in the fourth-quarter outlook. The growth outlook has become gloomier for next year as well, with the assessment deteriorating by one percentage point to 4-5%. The 2023 GDP forecast, on the other hand, has risen by 0.5 of a percentage point to 3-4%.

This article was first published in the Budapest Business Journal print issue of December 17, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.