Chinese Investors Lead the Charge in Boosting Hungarian Automotive

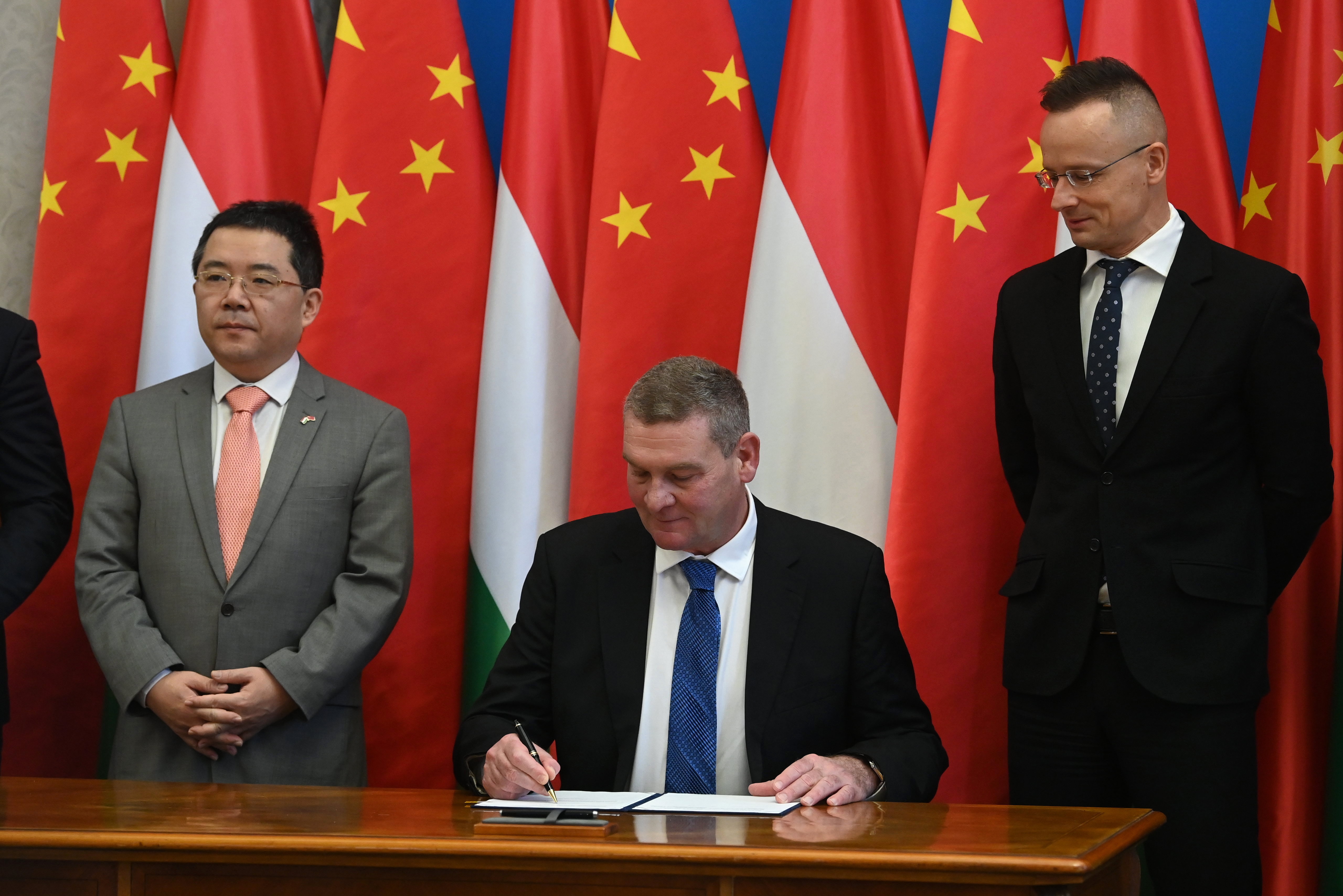

Chinese Ambassador to Hungary Gong Tao (left), Mayor of Szeged László Botka (sitting) and Minister of Foreign Affairs and Trade Péter Szijjártó at the signing of the pre-purchase agreement for the site of the future BYD factory in Szeged, at the Ministry of Foreign Affairs and Trade on Jan. 30.

Photo by Zoltán Máthé / MTI.

Hungary aims high in embracing investments that will deliver automotive’s electric transition. BYD’s multibillion-euro EV plant in Szeged and a series of other recent announcements showcase a gameplan built, at least in part, around Chinese investments.

Given the European Union has pretty much written in stone that 2035 is the deadline for producing zero-emission autos only, the road to electrification from here is pretty much a one-way street. As a result, what must now be viewed as European legacy brands are being placed under enormous pressure by competitively-priced Asian counterparts typically turbocharged with lavish state aid.

On that note, the European Commission has launched an anti-subsidy investigation against China. In a preemptive measure, Chinese investors have been extremely keen to find new strongholds on the continent: setting up shop within the EU neutralizes eventual tariff issues, cuts logistics costs to a vast market and helps serve European partners more easily.

The V4 countries (Czech Republic, Hungary, Poland and Slovakia), have been a hot target for Chinese automotive stakeholders in the past years, but since the early 2000s, the whole CEE region has welcomed them with open arms.

The Hungarian Government’s pro-China policy and lucrative incentive packages seem to sweeten deals effectively, as evidenced by recent investment announcements. To name a few examples, leading battery manufacturers Sunwoda and Eve Power have announced megaprojects and cathode-material producer Huayou Cobalt has committed to building a new plant worth nearly EUR 1.3 billion.

Little and Large

Smaller-scale projects have also been making headlines lately. Take Jiecang Linear Motion’s EUR 60 million development or the newly announced nearly EUR 105 mln factory for Evoring Kft. (a Shuanghuan Driveline company), that will build EV gears and shafts.

On top of all that, the news broke before Christmas that BYD would establish its first European EV plant in Szeged (175 km southeast of Budapest by road), since when the land purchase agreement has also been signed. The multibillion-euro project will create thousands of jobs. As Mayor of Szeged László Botka emphasized, up to 85% of the population favor the investment, which will be “one of the largest in the history of Hungarian economic policy.”

Exact numbers are not public yet, but this is no small endeavor considering that construction, scheduled to start on Feb. 10, will take place on a 300-hectare plot. Minister of Foreign Affairs and Trade Péter Szijjártó praised BYD’s effort accordingly: “It is set to ensure for decades that the Hungarian economy can stay on a growth track.”

The government’s “Eastern Opening Policy” has contributed significantly to the fact that the number one investment target of Chinese firms in the region has become Hungary, he added. BYD’s factory means that Hungary’s position will be further strengthened in the automotive industry. By 2018, it made the list of top 20 exporters in the world, while production value has grown by a factor of 3.5 in the past 15 years, he said.

BYD’s investment is also significant because the firm dethroned Tesla as the largest EV maker last year. According to Financial Times data, Elon Musk’s company handed over 484,000 million cars in the fourth quarter of 2023, while its Chinese rival delivered 526,000 in the same period.

‘Bring Your Dollars’

In fact, BYD was already the biggest seller of EVs and plug-in hybrids, jointly known as new energy vehicles (NEVs). With the standalone EV title also officially bagged, the new capacities in Hungary are bound to increase market share. The anecdote that the company’s initials stand for “Bring Your Dollars” might hold some truth. (Officially, it stands for “Build Your Dreams.”)

While construction is ongoing, the Chinese company has already found three retail partners in Hungary. Alongside Duna Auto and Wallis Motor, Schiller Auto has joined the dealer network. In fact, Schiller is shedding Opel, the brand the car dealer has been most closely associated with for decades, from its portfolio to make room for BYD.

While BYD’s arrival has been received with excitement locally, the discussion about the actual benefits of Asian automotive investments goes on. Many fear that only low-added-value assembly will be carried out in the country, that local suppliers won’t be able to join the value chain due to a lack of competence or need, and cheap migrant labor would pose a threat to the Hungarian workforce.

As Corvinus University professor Ágnes Szunomár highlights in a recent study, a shift to higher added-value activities seems to be an option only in the longer run. For now, China is unlikely to grant access to the upper links in the value chain.

To ensure that happens, it would make sense to ask for guarantees to engage local suppliers in exchange for incentives, and the V4 countries could also craft a joint strategy for approaching Chinese investments, Szunomár argues.

New Kids on the Board

Shortly after Nevijo Mance, the former CEO of Jaguar Land Rover’s Hungarian operation, was replaced by Ákos Garaba, two other automotive giants announced changes in local leadership. Audi has tapped Michael Breme to be the next chairman of the board of management of Audi Hungaria. The former head of Steering Business Area Product Lines and Module Management at Audi AG replaced Alfons Dintner, who had headed the Hungarian unit since October 2019 and left Volkswagen Group to focus on private interests.

The Mercedes Manufacturing plant in Kecskemét (95 km southeast of Budapest) also has a new boss, Jens Bühler, who first joined the automaker at its Sindelfingen HQ in 2003. He later oversaw production planning at the company’s plant in Beijing and was in charge of planning for the plant expansion in Kecskemét. He replaces Christian Wolff, who retired after leading the plant for eight years.

This article was first published in the Budapest Business Journal print issue of February 23, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.