Monetary Council Continues Tightening Amid Strong Recovery

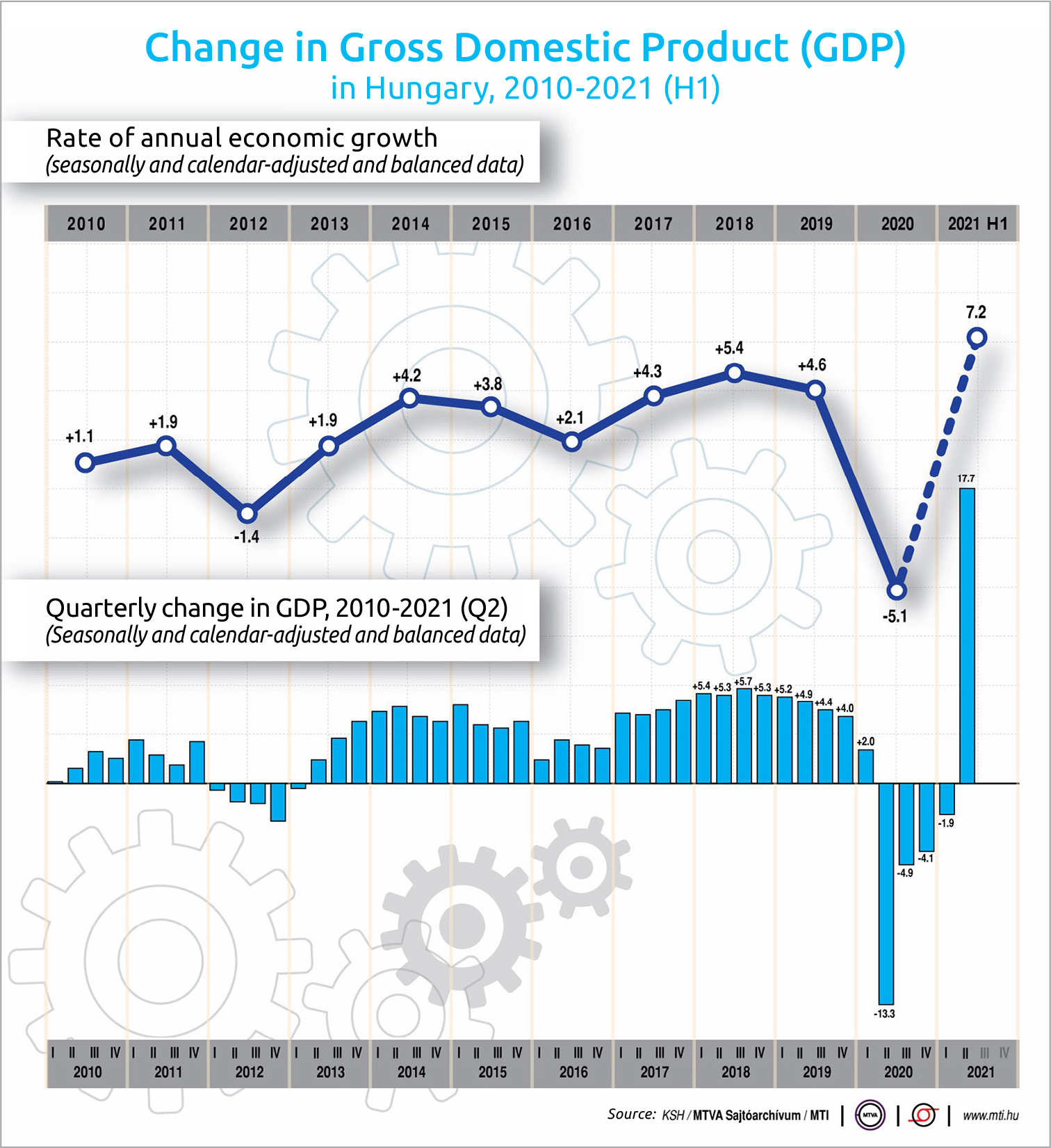

Hungary’s economy expanded by a massive 17.8% on an annual basis in the second quarter of the year, projecting a higher than previously expected full-year growth; some analysts now predict that 2021 GDP expansion will reach 8%. Meanwhile, the National Bank of Hungary has started to tackle inflation through a long-anticipated tightening cycle.

In light of the latest gross domestic product data, analysts and the government unanimously agree Hungary has all but left the economic element of the crisis behind. Hungarian GDP grew by an annual 17.9% after a double-digit decline in the base period, figures released by the Central Statistical Office (KSH) show.

This is the highest growth yet recorded, Minister of Finance Mihály Varga commented on the KSH release, noting that the fresh data shows the economic recovery in Hungary is moving forward at a pace that is “among the fastest in the European Union.”

According to a second reading of the data released on September 1, the structure of the growth was healthy in the second quarter, with all sectors contributing to the expansion. Pandemic-related government measures to help the recovery could contribute 8.4 percentage points to economic growth this year, Varga estimated.

Projections Raised

In the wake of this never-before-seen expansion, analysts raised their growth projections for the full year. Dávid Németh, K&H Bank senior analyst, said the bank is increasing its estimate from 6.7 % to “over 7%” in light of the Q2 data. That said, he also noted the downside risk of the global impact of further pandemic waves caused by COVID variants.

Gábor Regős of research institute Századvég emphasized that both annual and quarterly growth had exceeded expectations. In fact, the economy’s performance has already reached the level of the fourth quarter of 2019, meaning that at the macro level, the economy has already emerged from the crisis, he said. He also raised his previous estimations and now thinks economic growth might even extend to 8% in 2021.

London-based analysts were equally quick to point out that the Hungarian economy might expand at a faster pace than previously projected and say that the annual growth rate might reach 7-8%.

Earlier, Morgan Stanley analysts expected 6.1% growth in 2021. For 2022, Morgan Stanley gave a more moderate forecast, saying that the Hungarian economy might grow by 3.6%, partly due to the high base from this year. Analysts at the company expect further tightening in monetary policy as well; their current projection puts the base rate at 2.1% in the current cycle.

Inflation Targeted

In the meantime, the Monetary Council of the National Bank of Hungary continued its tightening measures, delivering a third consecutive rate hike. At its August 24 meeting, the council decided to raise its base rate to 1.5% from 1.2%. In addition, the bank hiked the overnight deposit rate, the overnight collateralized lending rate, and the one-week collateralized lending rate by 30 basis points to 0.55%, 2.45%, and 2.45%, respectively. At the same time, the MNB decided to begin gradually withdrawing the government securities purchase program.

The Monetary Council’s decision was once again aimed at tackling persistent inflationary pressures and reducing upside risks in the light of continuous wage growth and the strong recovery. Headline inflation dropped to 4.6% in July due to a base effect, although it remained well above the MNB’s target range of 3%, plus or minus one percentage point, while core inflation came in at 3.5%. The central bank now expects inflation to remain above its tolerance band until the end of this year before falling back into that range at the beginning of 2022.

Looking ahead, the MNB noted that global supply shortages, higher commodity prices, and international freight costs, along with recovering activity, represent the primary upside risks to inflation. Therefore, it outlined that August’s rate increase will be the third in a cycle of hikes designed to stabilize inflation around the bank’s target and reduce upside inflation risks.

Numbers to Watch in the Coming Weeks

Next Tuesday (September 14), the KSH will release its second reading of the July industrial output. According to the first reading, the volume of industrial production grew by 8% year on year. Based on working-day adjusted data, production rose by 10.2%. According to seasonally and working-day adjusted data, industrial output was 0.5% lower than in June 2021. The production level was similar to that before the pandemic in July 2019. The following day, July construction data will be published. The volume of construction output in June 2021, based on raw data, surpassed the previous year’s level by 27.8%. Based on seasonally and working-day adjusted indices, construction output rose by 3.5% compared to the May data. In the second quarter, construction producer prices increased by 9.3% compared to the same period of the previous year.

This article was first published in the Budapest Business Journal print issue of September 10, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.