Central Bank Continues Fine Tuning to Tackle Surging Inflation

As part of the new phase of monetary policy, the National Bank of Hungary unexpectedly raised rates again on Nov. 30, for the fourth time in two weeks. The latest move gives the MNB more room to maneuver amid a surging inflationary environment.

Once again, the National Bank of Hungary is using unorthodox measures as it continues the monetary tightening cycle it started in June. In an effort to support the Hungarian currency and keep surging inflation under control, the Monetary Council has deployed another tool. Now the base rate and the one-week deposit rate have taken different paths.

Only two days after its latest rate hike, the National Bank of Hungary introduced further moves: it raised the one-week deposit rate to 2.5% at its weekly tender on Nov. 18, which was followed by another step a week later, elevating the one-week deposit rate to 2.9%.

“The one-week depo rate will exceed the level of the base rate as long as the commodity and financial market risks relevant to the inflation outlook prevail,” a bank statement said, adding there was no time limit for this decision.

In an unexpected move on the last day of November, the MNB made its interest rate corridor “asymmetrical,” setting the stage for further monetary tightening. At a non-rate-setting meeting, the bank raised its collateralized loan rate by 105 basis points to 4.1% and the overnight deposit rate by 45 basis points to 1.6%.

“Widening and setting the interest rate corridor asymmetrically upwards is an integral part of the strategy of the new phase of monetary policy,” the bank said.

Forint Firms

The forint, which hit a new record low at HUF 372 per euro last week, immediately firmed after the announcement on Nov. 30, reaching HUF 366.1 versus the euro. According to ING Bank analyst Péter Virovácz, the move could help shore up the forint to around 360 by the end of the year. However, he warned that the bank’s tightening measures take effect with a substantial lag due to a complicated policy toolkit.

The MNB was the first in the European Union to undertake a tightening cycle to combat increasing price pressures in the middle of a faster-than-expected recovery from the COVID-19 pandemic. On June 23, the Monetary Council raised the base rate to 0.9% from the 0.6% that had been in effect since July of 2020.

Since June, the base rate has been raised five times, now standing at 2.1%. Despite the strong inflationary pressures, the bank slowed the pace of the rises in September (to 15 basis points from the previous 30) but accelerated again at the end of November. The MNB has raised its base rate by a combined 150 basis points since June.

The second reading of GDP data for the third quarter of 2021 has also come out. According to the Central Statistical Office (KSH) release, the volume of gross domestic product increased by 6.1% in Hungary in the third quarter compared to the corresponding period of the previous year. According to seasonally and calendar adjusted and reconciled data, the performance of the economy rose by 0.7% compared to the last quarter and by 6.1% compared to the corresponding period of the previous year.

In Q1-Q3 2021, the economic performance was 7.1% higher (6.8% higher according to seasonally and calendar adjusted and reconciled data) than in the same period of the previous year.

The latest figures confirmed that the expansion of the Hungarian economy in the third quarter was below expectations, said Gábor Regős, head of the macroeconomics department at Századvég Gazdaságkutató Zrt. The second readings figures reveal the reasons for this: industry was already known to be performing poorly, but the decline in agriculture and education was surprising, the analyst said.

Significant growth has been seen in several industries that have been particularly hit by the viral situation (e.g., transport, tourism) but have not yet reached pre-viral levels. The information and communications sector has soared and achieved double-digit growth. On the consumption side, consumption and investment have expanded substantially, perhaps at a slightly slower pace than expected, Regős said.

Concerning the fourth-quarter data, the question is to what extent the performance of the industry can speed up, how much this will be hindered by the shortage of raw materials, and what the effects of the fourth wave of the coronavirus will be, Regős concluded. He added that economic growth could exceed 6.5% this year on an annual basis, while it could be around 5.5% next year.

Numbers to Watch in the Coming Weeks

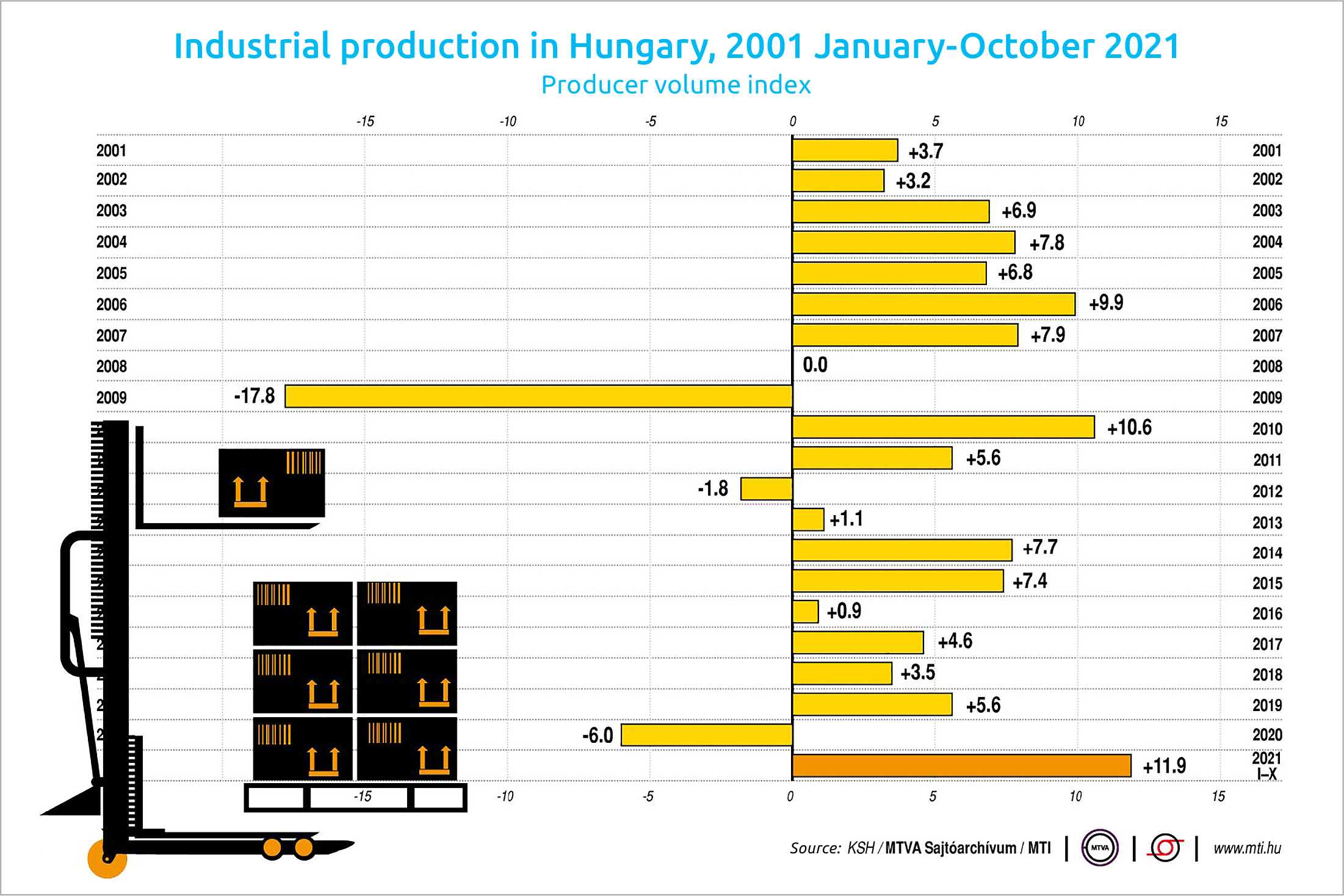

On Dec. 3, the KSH will publish October retail trade data. The performance of the Hungarian industry in October will be detailed on Dec. 7. The following day, KSH will release data on the November consumer price index.

This article was first published in the Budapest Business Journal print issue of December 3, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.