Two-digit Inflation Awaits on the Horizon

Although the latest rate-setting decision of the Monetary Council of the National Bank of Hungary (MNB) didn’t surprise the markets, the Hungarian currency nearly hit an all-time low against the euro on Wednesday morning. Analysts say the price caps in play curb price rises, but inflation is still expected to go above 10% in the coming months.

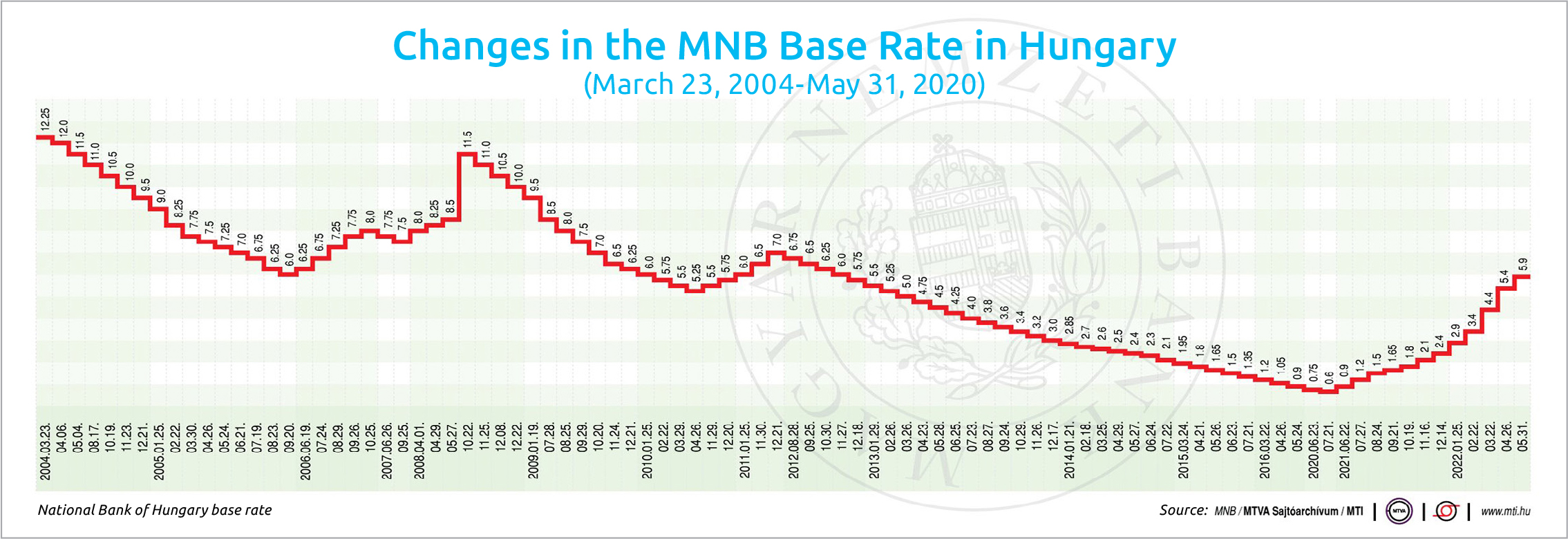

The Monetary Council of the MNB raised the central bank base rate to 5.9% at its meeting on Tuesday (May 31) and also increased the bookends of the interest rate corridor by the same amount.

Magyar Bankholding’s head analyst András Horvát expects the base rate to rise to a 7.5% peak by the middle of the year, gradually catching up with the one-week deposit rate, which could close at the end of the summer.

The analyst does not expect the one-week deposit and base rates to be reduced before the second half of 2023. By the end of next year, the one-week deposit and base rates are expected to fall to 6.25%. However, the condition for the decline is that inflation can be expected to return to the MNB’s 2-4% tolerance band after 2023, he said.

The analyst noted that current global inflation is mainly driven by a sharp rise in the cost of living, which will dampen economies through a decline in purchasing power. He underlined that it is essential for central banks to avoid overtightening monetary conditions so that interest rates are less of a brake on growth in a slowing economic environment.

Péter Kiss, investment director of Amundi Fund Management, said that the MNB had returned to its previous, more cautious rate hike range on Tuesday, which could delay the “closing” of the critical one-week deposit rate and the base rate, lengthening the rate hike cycle. This may be necessary due to longer-than-expected inflation and the weakening trend of the forint, he added.

Guiding Factor

The “double communication,” which is difficult for foreigners to interpret, may persist. However, while the central bank communicates almost exclusively about the base rate, he underlined that the one-week deposit rate is the guiding factor for the domestic economy. The analyst thinks that, given the current schedule, the two interest rates could meet in August and could then remain unchanged for quite some time, until the end of 2023.

Zoltán Varga, the senior analyst at Equilor Befektetési Zrt, expects inflation to exceed 10% in the coming months and for average inflation to be 9% for the whole year. The price caps the government has introduced on some food stables and gasoline and diesel, to run alongside the long-standing utility caps, have significantly curbed price increases, he thinks.

In terms of inflation processes, what is particularly important is how long and in what form the so-called “price stops” remain, he said. According to the analyst, the two interest rates may peak at 7.9% at the end of September if the base rate continues to rise by 50 basis points per month and the one-week deposit rate continues to increase by 30 basis points per month.

János Nagy, Erste Bank’s macroeconomic analyst, said that the tightening cycle could continue into the second half of the year after the rates meet again, and he expects the key interest rate, which mainly affects short-term interest rates, to peak at around 8% by the end of the year.

However, the vulnerability of the Hungarian currency, the uncertain outcome of the war, and the rule of law arguments with the European Commission continue to pose additional risks in the short term, and their unfavorable developments could overwrite current scenarios, he added.

Gábor Regős, head analyst at research company Századvég drew attention to the fact that the rate of increase in the one-week deposit rate will remain the same based on the MNB’s communication, meaning the pace of tightening is not slowing down, he argued. Raising interest rates alone will not stop inflation, but failing to do so would lead to further weakening of the forint and even higher inflation, he pointed out.

Optimal Interest

He remarked that the optimal interest rate level appeared as a new element in the central bank’s communication. According to the analyst, this term sheds light on the dilemma: although higher interest rates are needed to break down inflation, the rates should not be too high because of real economic costs.

The central bank will continue to raise the one-week deposit rate at the previous pace, said Barnabás Virág, deputy governor of the MNB, in an online press conference following the interest rate decision. The two interest rates could meet in the second half of the year, he added, noting that the one-week deposit rate could reach more than 7% in July. He confirmed that the cycle of interest rate hikes, the monetary tightening, will continue until conditions ensure that the central bank’s inflation target is met. The tightening will remain in the second half of the year for sure, he added.

“Stopping is not an option,” the deputy governor said in response to signs of easing at several regional central banks. The MNB is following its own path, and it would take a “longer time” to beat inflation, he added.

Virág emphasized that maintaining the flexibility of monetary policy is also crucial for the central bank to be able to react to the processes. If the situation arises, the central bank is ready to use “any means” to ensure the stability of the financial system and its primary goal is to achieve the inflation target in a sustainable manner, he said.

According to the central bank, inflation appears to be rising in the short term. An increase in prices above 10.5% by the end of May is possible; the figures will come out next week. MNB reckons food prices are 50% responsible for inflation. Increases in the price of raw materials and the external cost effects are being quickly incorporated into prices.

Numbers to Watch in the Coming Weeks

The Central Statistical Office (KSH) publishes April’s retail trade data today (June 3). Next week, on June 8, the May inflation figure will come out, followed by data on commercial accommodation establishments in April. The detailed data on April industrial production will be released on June 14.

This article was first published in the Budapest Business Journal print issue of June 3, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.