Slowing Expansion Moderates Growth Forecasts

The bigger-than-expected slowdown in Hungary’s economic growth in the third quarter has led analysts to lower their annual forecasts; however, the expansion is still dynamic, and the economy had already returned to its pre-crisis performance in the second quarter.

Hungary’s economy grew by an annual 6.1% in the third quarter of this year, slowing from a record high of 17.8% in the second quarter, the latest data published by the Central Statistical Office (KSH) shows. Adjusted for calendar-year and seasonal effects, GDP in the third quarter increased at the same rate. Quarter-on-quarter, GDP edged up 0.7%, while in the first nine months of the year, growth was an annual 7.1%.

The 0.7% month-on-month increase was below analysts’ expectations. Although it is still far from a bad performance, expectations had risen a lot after such a long series of positive surprises. On a yearly basis, the volume of GDP was up by 6.1% in Q3. This also means that Hungary is well above the pre-crisis level of real GDP: up by 1.5% compared to the third quarter of 2019, ING’s senior economist Péter Virovácz said.

Although not much is known about the details as yet, as the second reading of the data will be released only on December 1, Virovácz said ING expects services to be the main driver, as COVID-related restrictions were entirely removed by the third quarter.

“However, it seems that value-added growth in industry and construction probably performed below expectations. The reason behind this is obvious: equipment, material, and spare parts shortages were affecting output throughout the quarter,” he said.

“This could put a stronger-than-expected brake on export activity. Meanwhile, further improvement in domestic demand pushed import activity higher. As a net effect, Hungary’s external balances are worsening, negatively impacting GDP growth,” Virovácz explained.

Warning Note

Based on this, ING Bank has downgraded its economic outlook for this year and the next. According to Virovácz, the quarter-on-quarter performance and possible developments in Q4 are a warning to be more cautious on the GDP outlook.

“Given the shutdowns in industry and their negative impact on export activity, and considering the fourth wave of COVID-19, the fourth quarter economic performance could be somewhat weaker than we previously forecast,” he warned.

“At the same time, we also know that the government has mobilized significant fiscal resources for the last quarter of this year and the first quarter of next to boost GDP growth. This might partially offset the negative effects, although this stimulus to aggregate demand may also have a significant impact on import growth. In all, we are downgrading our GDP forecast to 7% year-on-year and 5% year-on-year in 2021 and 2022, respectively,” Virovácz added.

Gábor Regős of the pro-government Századvég Economic Research said the slowdown outpaced expectations, and the weakening of industry likely had a significant role to play accordingly.

“Fourth-quarter expansion could be limited by the impact of the fourth wave of the virus, a shortage of raw materials that halts industrial production, and supply difficulties,” he said in a note.

Unpleasant Surprise

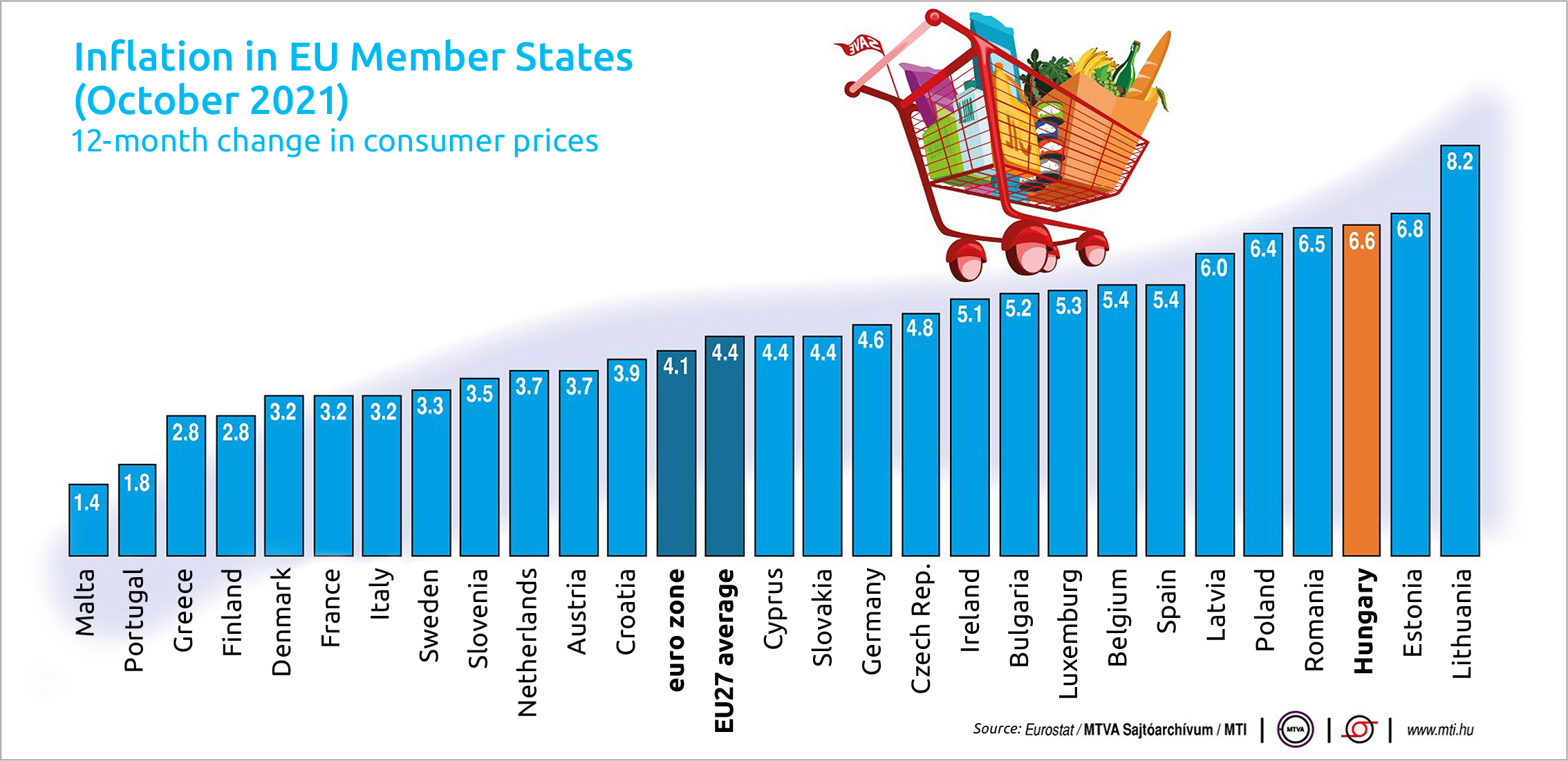

“A high inflation rate could also threaten growth through declining demand. In the light of the fresh data, this year’s expansion could be lower than previously expected, at around 7%, which is still strong, exceeding expectations in the spring,” Regős added.

The unpleasant surprise of the Q3 performance was partly due to the fact that the previous three quarters have brought much better results than experts had expected. That is why the projections for average annual GDP growth in 2021 have risen sharply so far: the median forecast was still 5% in the first half of the year, compared to 7.5% before the release of the latest GDP data.

Hungary’s economy had already equaled its pre-crisis performance in the second quarter of this year, and it continued to grow from there, even if with much smaller-than-expected momentum.

Minister of Finance Mihály Varga maintains his projection for this year’s growth. With a record growth of almost 18% in Q2, the economy has surpassed pre-pandemic levels, he said, noting that Hungary’s growth rate was above the EU average.

“All this shows that a supportive budgetary policy is now bearing fruit, and the government’s measures are contributing to the economy’s relaunch while mitigating negative external impacts,” he said. Varga added that the government was still expecting 6.8% growth for the full year.

Tightening Accelerates

The Monetary Council of the National Bank of Hungary raised the base rate by 30 basis points to 2.1% at its latest meeting on November 16. It also raised both sides of the interest rate corridor by 30 basis points. Following 15 basis point hikes in the previous two months, the policymakers accelerated the tightening cycle after inflation reached 6.5% in October.

“A persistent rise in external inflationary pressures and increasing second-round inflation risks have necessitated more extensive and longer-lasting monetary policy tightening,” the council said in a statement released after the meeting. The policymakers again signaled a continuation of monthly hikes while noting that the central bank’s next quarterly Inflation Report, due out in December, “will be decisive in determining the further extent of interest rate hikes.”

Numbers to Watch in the Coming Weeks

The KSH will publish third-quarter investment data on November 26. October labor market figures will be out on November 29. More detailed data on the third-quarter GDP growth will be released on December 1.

This article was first published in the Budapest Business Journal print issue of November 19, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.