Risk Premiums in Central Europe During Covid

Les Nemethy and François Lesegretain look into Risk Premiums in the Visegrád Four (V4) countries during the Covid Era.

Risk premium may be defined as the differential in the interest rate payable on bonds of a particular country compared to the lowest risk country. Usually, it is the 10-year bond rate that is used as the basis for comparison. For decades, the risk premium of all currencies globally was measured against the U.S. dollar. More recently, European countries began calculating their risk premiums against the German bond yield, the lowest risk European country, with an AAA credit rating.

Generally, during times of crisis, there is a flight to safety. Investors, fearing the worst, invest more into the lowest risk countries; hence the interest premium of interest rates in higher risk developing countries becomes higher.

This means both that (a) a higher interest rate is required to keep lenders interested in investing in developing countries and (b) that the cost of capital increases in developing countries. This is the same “cost of capital” that underpins the valuations of corporations.

As the so-called discounted cash flow valuation method discounts future capital flows to a net present value, the higher the cost of capital, the more the value of companies falls. For example, in past financial crises, the value of companies on the stock exchanges of developed countries fell, but the value of companies in developing countries typically fell much more, on average. A similar phenomenon, of course, exists for privately held corporations but is less visible given that they are not publically listed.

One might have expected risk premiums to increase in developing countries and the V4 during the covid crisis of 2020. Let’s look at the evidence.

According to the website countryeconomy.com, the broad trends show that risk premiums increased in the Czech Republic, compared to Germany, but they declined substantially in Poland and a bit in Hungary (data for Slovakia was not available).

This contrasts significantly with the 2008-2009 crisis, where the risk premium for Hungarian 10-year bonds reached a whopping 10% higher than German bonds.

It is also interesting to note that, according to an analysis by PwC, globally, there seems to have been a greater increase in risk premiums in developing countries than in Central Europe.

While during Q1 2020, risk premiums increased by on average only 0.5% in Europe, they increased by some 2.7% in North Africa and Middle East (MENA), PwC says. Some emerging markets are likely to have a lower fiscal capacity to respond to the shock (less ability to spend their way out of a crisis, delayed access to vaccines, etc.); hence they are more vulnerable to a broad-based economic downturn.

Central Bank Effect

One does not have to look far for an explanation for the behavior of risk premiums. The European Central Bank (ECB) has had a massive effect on dampening the severity of the COVID-19 crisis, thanks to quantitative easing. The ECB also announced the formation of the Next Generation EU (NGEU) fund, a massive EUR 750 billion in spending.

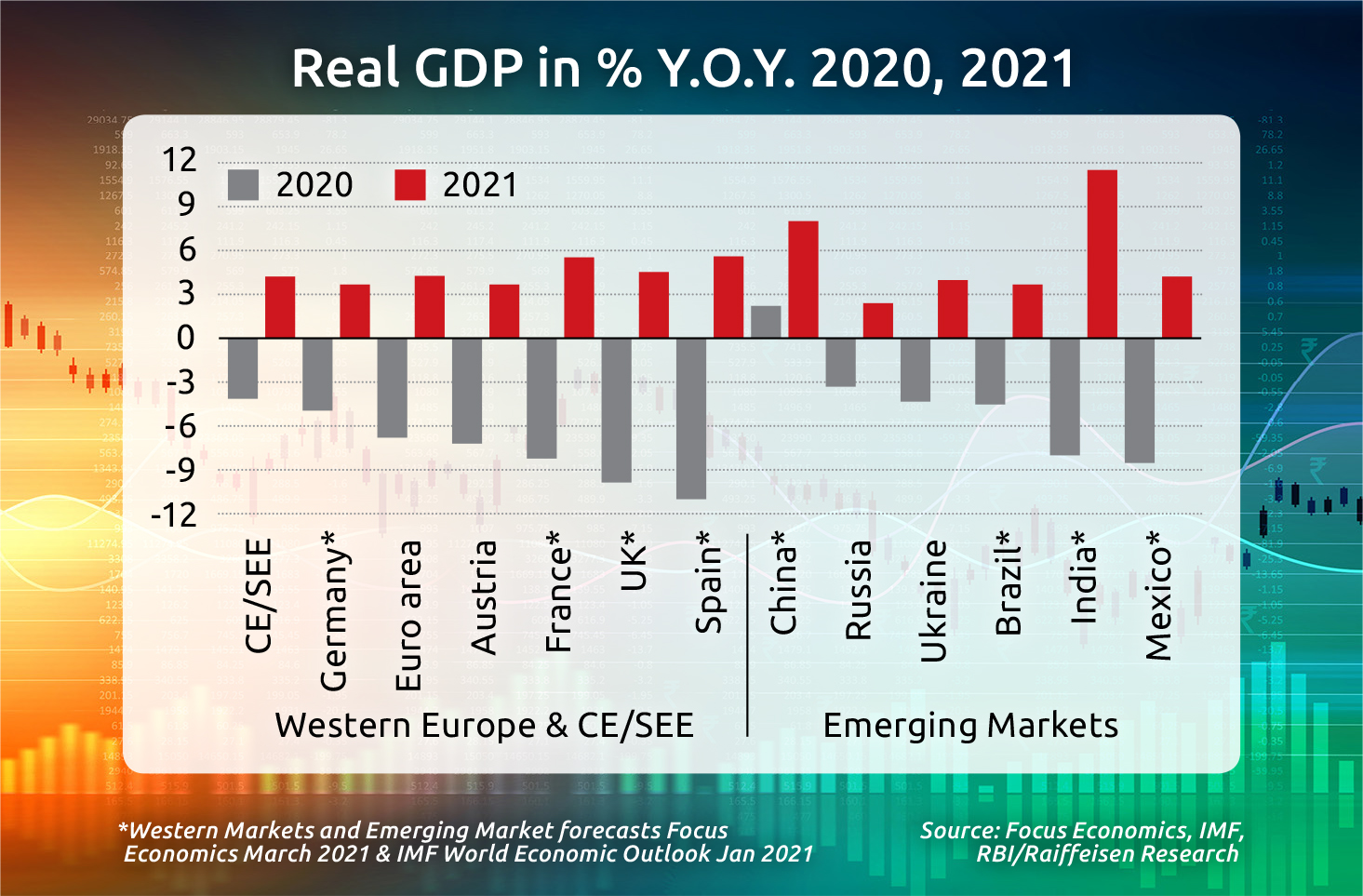

Even though the NGEU is only in the early stages of disbursement, the expectation of this stimulus also had an effect on buoying markets. As can be seen from the chart below, European GDP is expected to bounce back quite well in 2021.

The allocation of the EU Recovery Fund or the NGEU instrument remains very supportive for the EU member countries from Central and Southern Europe. About 20% of the grants and guarantees under the NGEU should go to this group of countries, while their EU GDP share stands at just under 10%. This is good news as the region clearly benefits from redistributive elements within the NGEU.

It should be borne in mind that, parallel to the NGEU, there has been a decline in grants and guarantees destined by the EU to the CEE region, from EUR 100 to EUR 80 billion, which still represents some 6-7% of regional GDP for 2020. The net effect is still highly positive for the region.

In conclusion, COVID-19 has not been disastrous for the CEE countries’ risk premium and cost of capital. The ECB (like the U.S. Fed) has been much more stimulative than during the financial crisis of 2008, which has had a beneficial effect in reviving economic growth and tamping down risk premiums.

However, there is no free lunch: as discussed in earlier articles, the massive level of stimulus in the developed world, including Europe, could lead to a period of inflation or stagflation. Central banks have shown some success in tamping down risk premiums in the short run. But will the stimulus lead to inflation? The jury is still out, but there is a good chance it will be more than transitory.

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. A former World Banker, he is author of Business Exit Planning (www.businessexitplanningbook.com) and a former president of the American Chamber of Commerce in Hungary.

This article was first published in the Budapest Business Journal print issue of September 10, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.