Monetary Tightening Will be Transitory. Inflation is Here to Stay.

Op-ed by Les Nemethy

Monetary policy over the past few years has been the most accommodative in the history of financial markets. The U.S. Federal Reserve has been purchasing about USD 80 billion in U.S. Treasuries and USD 40 bln in mortgage-backed securities per month. The European Central Bank and other major central banks are following similar policies.

The Fed has now changed the game. Recently released minutes of the September Federal Reserve meeting indicate that, by mid-November, the Federal Reserve will begin to taper bond purchases by USD 10 bln in bonds and USD 5 bln in mortgage-backed securities per month. This would imply completion of tapering by mid-2022, after which the Fed might choose to raise its benchmark interest rates. Similarly, the Bank of Canada recently announced its intent to reduce hyper-accommodative monetary policy.

Bond purchases drive the price of bonds up, hence yields and interest rates down, serving to prop up financial markets. The concern is that, by tapering bond purchases, interest rates may rise, and financial markets may crash, as happened during the 2013 “taper tantrum,” compelling central banks to augment bond purchases to new heights to prevent a full-blown recession or depression.

This article looks at whether central banks will succeed in this newest round of monetary tightening, or whether a repeat of the 2013 taper tantrum is likelier; and if we do experience a taper tantrum, what is the fallback strategy for central banks?

On the first question, I am of the view that a repeat of the 2013 taper tantrum is the likelier scenario.

History would judge today’s central bankers irresponsible if they did not at least try to wean the world from all this monetary stimulus, which creates a crazy world of negative interest rates and distorted economic signals; interest rates, the price of capital, are perhaps the most important set of prices in the economy.

Why do I believe this latest balancing act of tapering will fail? Two very simple reasons: much higher global debt levels and much higher inflation than in 2013.

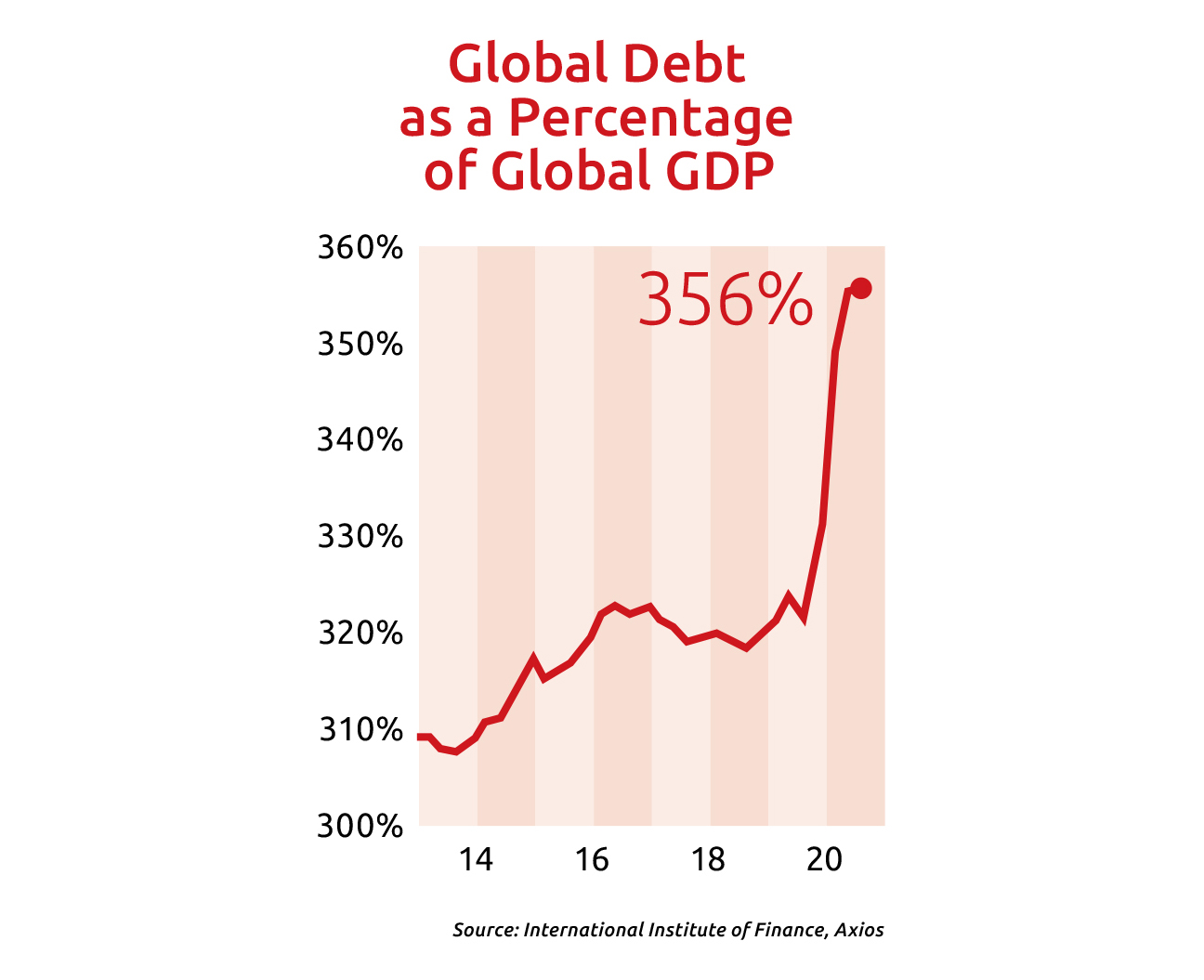

As can be seen from the chart, total global debt (government, corporate and individual) has surged from below 310% in 2013 to more than 355% in Q4 2021.

The world today is less capable of withstanding higher interest rates than in 2013. Given the mountain of debt, even a modest rise in interest rates will squeeze corporate profits, trigger mortgage defaults, and swell deficit spending by governments, triggering at least a recession and an adverse reaction by financial markets.

Inflation is also in a very different place today compared to 2013. Whereas back then, inflation was well below 2% in the United States, EU, and other developed countries, today’s inflation rates are closer to 5% and accelerating. Many central bankers are stretching the timeline of what they mean by “transitory.”

We are seeing a self-inflicted energy price shock caused by poor planning in transitioning to a green economy. Wind does not always blow, and the sun does not always shine: alternative energies today are singularly incapable of supplying baseload energy. Meanwhile, capital expenditures to bring new fossil fuels on stream have significantly diminished.

Two other major supply-side bottlenecks facing the world today are microchips and shipping containers. Most experts maintain that it will take years for these bottlenecks to work themselves out of the system.

If you accept the view that these and other bottlenecks will continue to exert inflationary pressures for the next few years, within that time horizon, the expectation of higher inflation may be enough to prevent inflation from settling back to lower levels. The anticipation of higher non-transitory inflation rates could drive interest rates up, once again contributing to the likelihood of a tantrum.

The fallback scenario is financial repression. Under this scenario, central banks would perform whatever bond purchases are necessary to keep treasury rates at 4-6% lower than inflation, allowing governments to inflate away the national debt.

This has been done successfully at various historical junctures (for example, in the United States during the post-World War II decade). Financial repression is a form of institutionalized theft, with savers (e.g., anyone holding cash or debt, such as pensioners and pension funds) subsidizing borrowers (including governments).

In conclusion, both equity and bond markets are likely to experience headwinds in the coming months. At some point, when economies can no longer support higher interest rates, markets may experience a taper tantrum (resulting in a crash of both bond and equity markets). Having failed at weaning the world from monetary expansion, central banks may settle for a policy of financial repression.

Brace yourself for market volatility, followed by financial repression.

Disclaimer: This article is for educational purposes only and must not be construed as investment advice. Investors should obtain their own financial advice.

Les Nemethy is CEO of Euro-Phoenix Financial Advisers Ltd. (www.europhoenix.com), a Central European corporate finance firm. He is a former World Banker, author of Business Exit Planning (www.businessexitplanningbook.com), and a previous president of the American Chamber of Commerce in Hungary.

This article was first published in the Budapest Business Journal print issue of November 5, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.