Central Bank Says Monetary Policy Enters New Phase

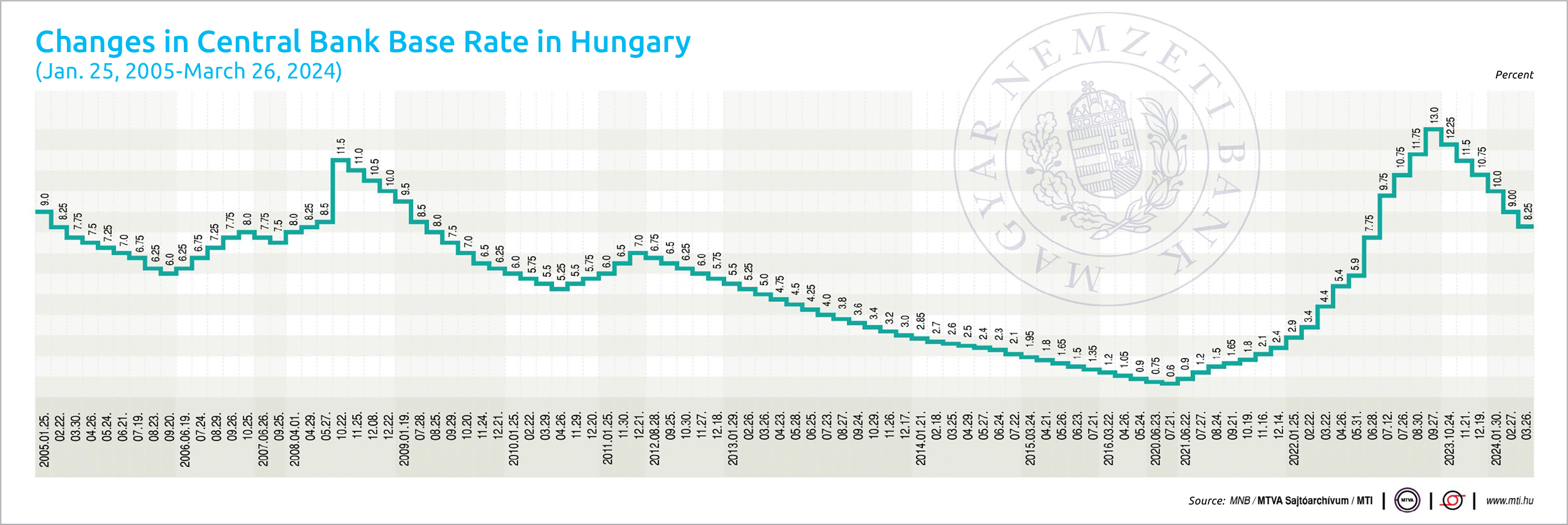

The key interest rate was lowered by 75 basis points to 8.25% at the latest rate-setting meeting of the National Bank of Hungary (MNB). The decision underscores that the acceleration of the interest rate reduction cycle to a 100 basis points cut in February was only temporary.

Hungary’s central bank rate-setters reduced the base rate by 75 basis points to 8.25% at a regular policy meeting on March 26. The Monetary Council also decided to lower the symmetric interest rate corridor in tandem, bringing the overnight deposit rate to 7.25% and the O/N collateralized loan rate to 9.25%.

As a result of messages of acceleration in the short term and relative tightening in the medium term, the market was more divided than usual before the latest interest rate decision. While the consensus was for a 75 basis point interest rate cut, analysts also expressed expectations as low as 50 and as high as 100 basis points.

That uncertainty is principally triggered by the duality seen in the economy. The MNB must consider both inflation and financial stability aspects in its interest rate policy, which can lead to an apparent contradiction in some scenarios.

At the previous policy meeting in February, the council cut the base rate by 100 basis points. In a statement released after the latest rate-setting meeting, the council wrote, “Over the past few months, disinflation in the Hungarian economy has been stronger than expected, while external and domestic demand pressures have remained persistently low.”

Volatile Sentiment

The MNB continued, “However, in the volatile international sentiment, the risk premium on Hungarian assets has also risen recently. According to the assessment of the Monetary Council, the continued strong and general disinflation allows a further reduction in the base rate, while the increasing financial market risk aversion justifies a slower pace than in February.”

Interest rate decisions started to become more exciting around the beginning of the year. After it became clear that inflation was decreasing more strongly than expected, the central bank considered accelerating the pace of interest rate cuts of 75 basis points that had taken place until then.

However, this did not happen in January because, although the MNB had already prepared the ground for it in terms of its external communications, monetary policy became more cautious at the last moment in response to the turbulence in the markets.

In February, however, the 100-basis-point cut was made, but the central bank paired interesting messages with it. On the one hand, it indicated that, by the middle of the year, it would like to lower the base interest rate to 6-7% while, on the other hand, it implied that the base interest rate priced in for the end of the year was unrealistically low.

According to the latest communication from the central bank, by the middle of the year, the key interest rate may drop to a level of around 6.5-7%. The phase of monetary policy operating with rapid steps has come to an end, and the decision on March 26 marks the start of a new phase, said MNB Deputy Governor Barnabás Virág at the briefing following the Monetary Council’s interest rate decision.

Slowing Pace

According to Virág, the pace of interest rate cuts will slow in the second quarter; interest rate cuts of 25-50 basis points may come in the subsequent sessions, so the MNB has changed the previous 6-7% interest rate expected by the middle of the year to 6.5-7%.

“The February inflation data would have allowed the central bank to cut interest rates even more, but due to changes in the risk environment, the central bank returned to the previous 75 basis point rate cut pace,” says MBH Bank senior analyst Márta Balog-Béki.

“Following the decision and the subsequent announcement of the MNB, it may be an open question at the next interest rate meeting whether the development of inflation data and risk perception leaves room for a 75 basis point interest rate cut in April,” she notes.

In the coming months, the annual inflation rate may gradually increase again, and political frictions related to the EU, the weakening of the forint, geopolitical tensions and the volatility of international investor sentiment also justify a cautious monetary policy.

“According to our expectation, the return to the inflation target will be realized more slowly; we expect this in 2025 only. We maintain that, by the beginning of the third quarter of 2024, the base rate may fall to close to 6%, which may remain until the end of the year, keeping in mind the motive of caution,” Balog-Béki adds.

Forecast Updated

The central bank also published its quarterly Inflation Report at the end of March. The document reveals that the National Bank of Hungary has lowered its forecast for 2024 average annual inflation to 3.5-5% from 4-5.5% in the previous report published in December. According to the MNB, inflation will fall to 2.5-3.5% in 2025. Virág said it would temporarily rise in the middle of 2024 because of the retrospective pricing of market services and base effects. He added that the 3% inflation target would only be reached in a sustainable manner in 2025. The fresh report forecasts 2-3% GDP growth in 2024, accelerating to 3.5-4.5% in 2025.

This article was first published in the Budapest Business Journal print issue of April 8, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.