Bold Move by Central Bank Surprises Markets

The twin threats of sky-high inflation and a record-weak forint have forced the National Bank of Hungary (MNB) to change tack and pick up the pace of its tightening cycle. The MNB surprised the markets with a massive rate hike, in response to which thethe forint jumped.

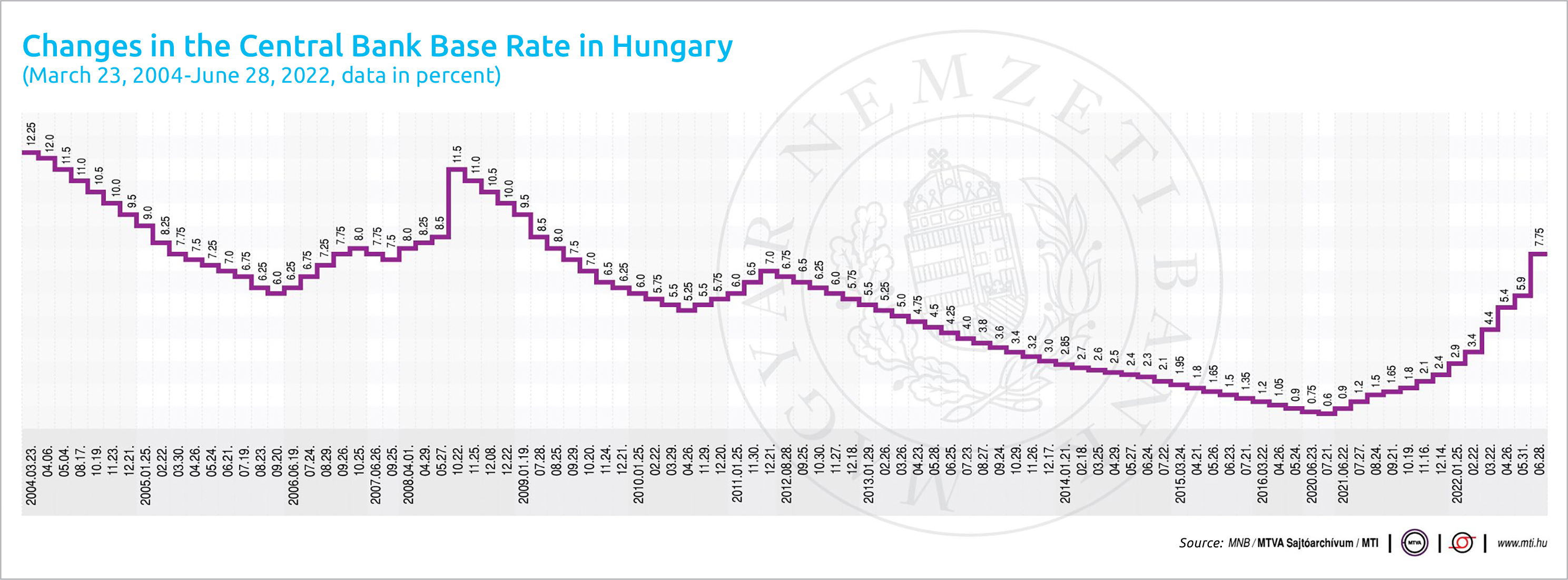

Way in excess of market expectations, the MNB raised its key rate by 185 basis points to 7.75% at its latest rate-setting meeting on Tuesday (June 28). Both sides of the interest rate corridor were raised by 135 basis points, with the overnight deposit rate increased to 7.25%, and the overnight and one-week collateralized lending rates upped to 10.25%.

Due to the increased challenges, the central bank’s Monetary Council considered it necessary to close the gap between the base rate and the one-week deposit rate, said MNB deputy governor Barnabás Virág at a press conference following the meeting of the council.

According to Virág, the council has continued its interest rate tightening cycle by taking a decisive step to anchor inflation expectations and mitigate second-round inflation risks. In addition, it believes that increasing the one-week deposit rate to the level of the base rate at the weekly tender following this decision is warranted.

The central bank will also extend the use of the foreign exchange liquidity-providing swap facility from July and will stand ready to use it within quarters as well. The step aims at ensuring that the short-term rate in every sub-market, particularly in the swap market, at all times develop consistently with the level of short-term rates deemed optimal by the Monetary Council.

Active Presence

By maintaining an active presence in the market, the MNB enhances the effectiveness of monetary policy transmission, thereby supporting the achievement and maintenance of price stability.

The central bank’s decisions are 110% focused on the fight against inflation, said Virág; it is of crucial importance to anchor inflation expectations and avoid second-round inflationary effects, he emphasized.

“We need every percentage point, every basis point in the fight against inflation. The Monetary Council will continue raising interest rates as long as necessary. That’s the key to the decisions in the next period,” he said.

According to Gergely Suppan, senior analyst of Magyar Bankholding, the base rate may peak at 8.5% and then decrease to 7% by the end of 2023. Suppan added that inflation is high worldwide, with the price of basic commodities, especially, on the rise.

That means the decline in purchasing power will in itself hurt economies, so central banks must refrain from overtightening monetary conditions. As central bankers cannot really influence supply price shocks, their main goal may be to eliminate second-round effects, anchor inflation expectations, and prevent the price-wage spiral, Suppan emphasized.

Not Unprecedented

Zoltán Varga, an analyst at Equilor Befektetési Zrt., was equally surprised by the decision but noted that it is not unprecedented. In the United States, the Fed announced a significant change of 75 basis points two weeks ago, and the European Central Bank, which last raised interest rates 11 years ago, may decide the same next month, Varga reckoned.

Erste’s macroeconomic analyst János Nagy said that raising the one-week deposit rate and the base rate to the same level would make it easier for market participants to follow monetary policy developments. He also emphasized the extension of the use of swap instruments. He said the change might help exploit the banking system’s excess liquidity.

According to Tamás Isépy, an analyst at Századvég Konjunktúrakutató Zrt., both high inflation and the weakening of the forint justified the change in interest rates. He believes the extraordinary increase in interest rates, in line with international trends, is mainly due to the higher-than-indicated inflation path in the new central bank forecast, which is due to war processes and the development of raw material and energy prices.

Isépy pointed out that the base rate and the critical one-week deposit rate will be at the same level. Monetary tightening may still be needed, meaning that interest rate hikes could continue for the rest of the year, he added.

The forint jumped after the rate hike, the most significant single rate move since 2008. According to Bloomberg analysts, the forint’s plunge forced the central bank to change tack and speed up monetary tightening instead of slowing it, as signaled previously. The currency gained more than 1% after the move. The forint has been treading near record lows after breaching the 400 per-euro level for the first time two weeks ago.

Numbers to Watch in the Coming Weeks

On July 6, the Central Statistical Office (KSH) publishes its first estimate of May’s industrial data. May retail trade figures will also come out on the same day. On July 8, June consumer prices will be released.

This article was first published in the Budapest Business Journal print issue of July 1, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.