Annual Inflation Hits 23-Year High in May

The annual inflation rate in Hungary accelerated to 10.7% in May, up from 9.5% in the previous month, surpassing market expectations. Further rises are expected.

Consumer prices were 10.7% higher on average in May 2022 than a year earlier, the highest in 23 years. The most significant rises over the last 12 months were measured for food and consumer durables.

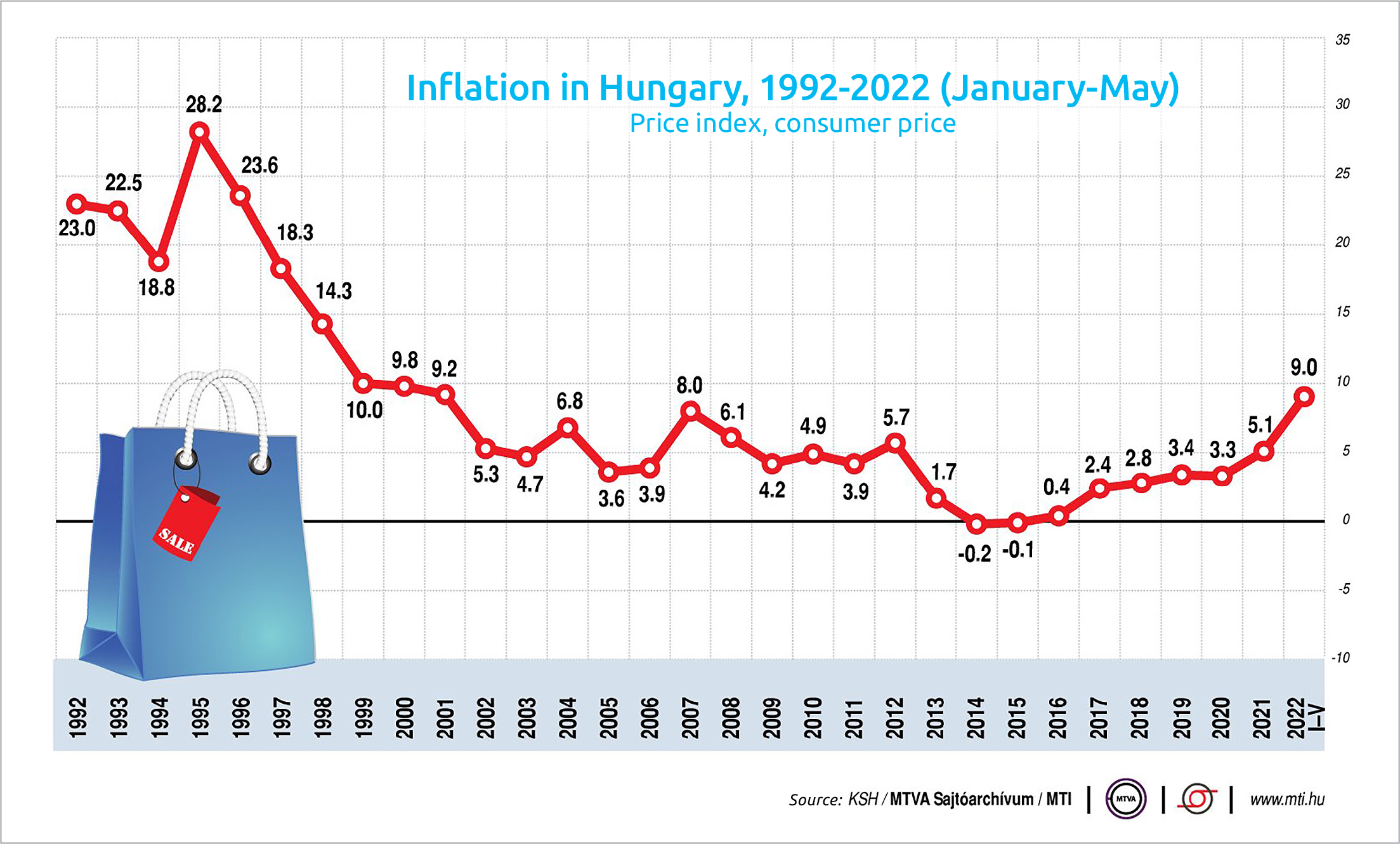

In just one month, consumer prices increased by 1.7% on average, according to the latest data released by the Central Statistical Office (KSH). In January-May of this year, consumer prices were up by 9% for all households on average and by 8.7% among pensioner households, when compared to the same period of the previous year.

According to KSH, the highest price rises seen during the last 12 months were recorded for food and consumer durables in May. Motor fuel prices were 10.8% higher than a year earlier, and the cost of household repairs and maintenance goods rocketed by 28.3%.

To try and tackle the high inflation, Hungary’s government capped the prices of six basic food items (sugar, wheat flour, sunflower oil, pork leg, chicken breast, and cow’s milk) from February 1, fixing the prices at their level on October 15. Despite the measure, known somewhat clumsily in the English translation as the “price stop,” food prices increased by 18.6% in May on an annual basis.

In November 2021, the government capped fuel prices, a measure that will stay in force until at least July, according to Prime Minister Viktor Orbán.

Global Pressure

Inflationary pressure has been present worldwide for a while now. According to the latest quarterly forecast by Fitch Ratings, the global economy is likely to grow at a much slower-than-expected pace this year due to the demand effects of increasing global inflationary pressures and renewed Chinese restrictions on coronavirus hotspots.

Márton Nagy, the newly appointed minister of economic development, was quick to point out that inflation in Hungary is caused mainly by international tendencies. Eighty percent of inflation in Hungary is of global origin, with rising energy and grain prices in the background, he told journalists on Tuesday (June 14).

The minister spoke about the weakening of the forint in recent days also being a result of global developments that can be traced back to the U.S. inflation data released last Friday (June 10).

“Hungary cannot escape the influence of global processes either; the exchange rate of the forint is also driven by these processes,” said Nagy, who also drew attention to the growing inflationary tensions and the risk of a recession.

Bond yields are rising, posing another challenge not only for countries in the region but also for southern European states. According to the minister, if the war in Ukraine continues, 2023 will be a more challenging year than 2022; it all depends on when the conflict ends, he said.

Exceeding expectations, inflation rose to 10.7% in May due to substantial price increases, Gergely Suppan of Magyar Bankholding, commented on the data. The analyst said that increasing price pressure is reflected in the fact that core inflation jumped very sharply to 12.2%, way above expectations. The surprise was caused by the significantly higher-than-expected rises in food and spirits prices, he said.

Sharp Rises

With much higher-than-expected inflation and sharp price rise of raw material and energy costs, especially in the food production chain, the bank holding is raising its average inflation expectation to 10% this year, which could decline to 5.7% next year, he noted.

Analysts at ING Bank warned in a note that inflation in Hungary is expected to rise further in the coming months as the economy continues to show a significant demand-supply mismatch. According to them, the labor shortage, rising wages, and other supply-side shocks are increasingly spilling over into consumer prices, with companies enduring significant pricing power.

Recent surveys are showing that roughly 60-80% of companies (depending on their respective sectors) are planning further price rises, the analysts said.

As far as monetary policy is concerned, with underlying inflation also strengthening to an extraordinary extent (1.8% month-on-month), the National Bank of Hungary (MNB) will hardly have an opportunity to think about stopping the interest rate hike cycle anytime soon.

“In our view, the recent data will urge the central bank to rethink its tightening path both from the perspective of its length and its peak,” ING Bank wrote.

Hungary’s central bank slowed the pace of its rate hikes on May 31, raising its base rate by 50 basis points to 5.9% even as inflation was seen accelerating to double-digits in the coming months before it could peak later this year. Having held a non-policy meeting on Tuesday, the next rate-setters’ meeting of the MNB’s Monetary Council is due on June 28.

Numbers to Watch in the Coming Weeks

On June 23, May labor market statistics will be published by the Central Statistical Office (KSH). In April 2022, the average number of employed persons aged 15–74 was 4.6 million, and the unemployment rate was 3.6%. On June 24, April earnings data will be released.

This article was first published in the Budapest Business Journal print issue of June 17, 2022.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.