Rate Hikes Continue as Expected

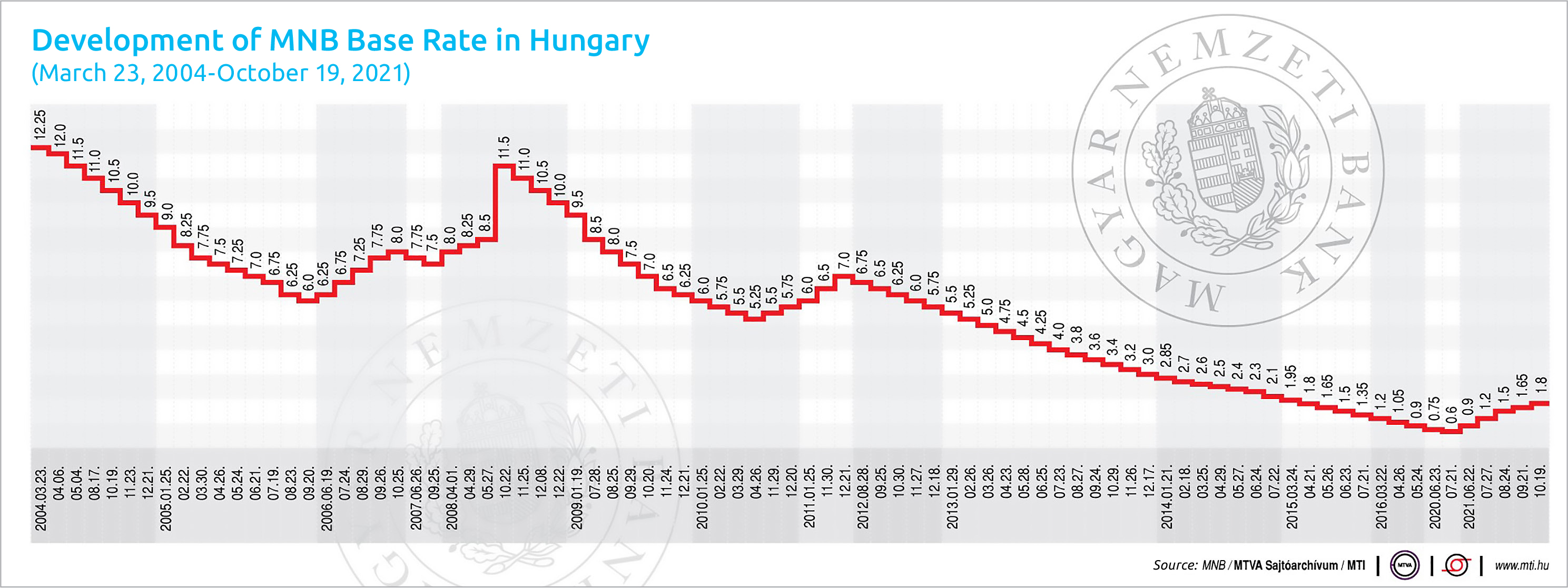

The National Bank of Hungary (MNB) continued its tightening cycle, raising the key rate by 15 basis points to 1.8% at its latest rate-setting meeting on Tuesday (October 19). The council also decided to increase the overnight deposit rate by 15 basis points to 0.85% and the O/N and one-week collateralized loan rates by 15 basis points to 2.75%, marking the bottom and top, respectively, of the central bank’s “interest rate corridor.”

The Monetary Council of the MNB says it is executing the tightening at a steady pace after inflation rose to a nine-year high of 5.5% in September. The MNB was the first of the European Union member state central banks to embark on rate hikes back in June and has gone on with it each month since then.

Some analysts, however, say that the MNB should embrace a more hawkish tone in its policy, as the Hungarian economy, like other economies in Europe in the course of recovery, is struggling with soaring energy costs, tight labor markets, and rising wages.

While the world’s leading central banks have maintained loose monetary conditions in the past month, there has been a shift in their communications towards a tighter tone. At its September policy meeting, the U.S. Federal Reserve decision-makers signaled that a moderation in the pace of asset purchases might soon be warranted if the economy develops in line with expectations.

Also in September, the European Central Bank slowed the pace of purchases under the Pandemic Emergency Purchase Program (PEPP). The region’s central banks have all tightened policy to blunt the inflation spike but to differing degrees. The Czech National Bank delivered a 75 basis point hike in September, while Poland implemented a 40 basis point hike that markets had not anticipated this month.

The Monetary Council is committed to achieving and maintaining price stability, the MNB wrote in its statement following the decision. In the decision-makers’ assessment, the inflation outlook continues to be surrounded by upside risks that might prove to be more persistent than earlier expected.

For this reason, the council said it considers it necessary to continue monthly interest rate tightening. Further, it said it would continue the cycle of interest rate hikes until the inflation outlook stabilizes around the central bank target of 2-4% in a sustainable manner and inflation risks become evenly balanced on the horizon of monetary policy.

Higher Inflation Path

The Monetary Council said the “significant” rise in commodities prices in recent weeks “points to a higher inflation path in the short run than expected in September,” when the central bank released its quarterly Inflation Report.

In that report, the MNB put CPI at more than 5% for the rest of 2021 before returning to its 2-4% tolerance band in Q2 2022 and stabilizing around the 3% target in the second half.

In September, headline inflation rose to a nine-year high of 5.5%, while the central bank’s tax-adjusted core inflation gauge rose to 4%, the top of its tolerance band. Significant price rises were measured over the last 12 months for alcoholic beverages and tobacco as well as motor fuels. In one month, consumer prices increased by 0.2% on average.

The government expects the inflation rate to start falling from the beginning of 2022 and sees the situation “normalizing” by the summer of 2022 to make the mid-term 3% target achievable by yearend, Minister of Finance Mihály Varga said at a press conference on October 19. The CPI target should be achieved gradually so as to avoid a “new wave of recession,” Varga added.

According to London-based analysts, inflationary pressures will increase in the coming months. Global financial advisor Morgan Stanley said the MNB’s Monetary Council had given the markets tougher forward-looking guidance. According to the company, the announcement that the risk of inflation may prove to be more stubborn than previously expected suggests that the tightening cycle could be extended to 2022.

Analysts at Morgan Stanley’s London office said they currently maintain their forecast that the MNB will make two more interest rate increases, each of 15 basis points, before the end of this year, as energy prices remain high, further increasing the inflationary pressure.

However, according to analysts at Capital Economics, there are concerns in the market that the MNB’s monetary policy is not aggressive enough given the current inflationary environment, especially since the pace of interest rate hikes has slowed from an initial 30 basis points to 15. The company expects annual inflation in Hungary to rise above 6% in November and to remain above the upper edge of the central bank’s tolerance band until late 2022, longer than currently expected by the MNB.

Numbers to Watch in the Coming Weeks

As for the next two weeks, the macroeconomics calendar is not very packed with releases. On October 28, the Central Statistical Office will publish employment and unemployment data for September. In August, 4.67 million people worked in Hungary, while the unemployment rate stood at 4%. On October 29, earnings statistics for August will be out. The National Bank of Hungary will publish the abridged minutes of this week’s latest Monetary Council rate-setting meeting on November 3.

This article was first published in the Budapest Business Journal print issue of October 22, 2021.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.