MNB Grants License to Local iBanFirst Fintech Branch

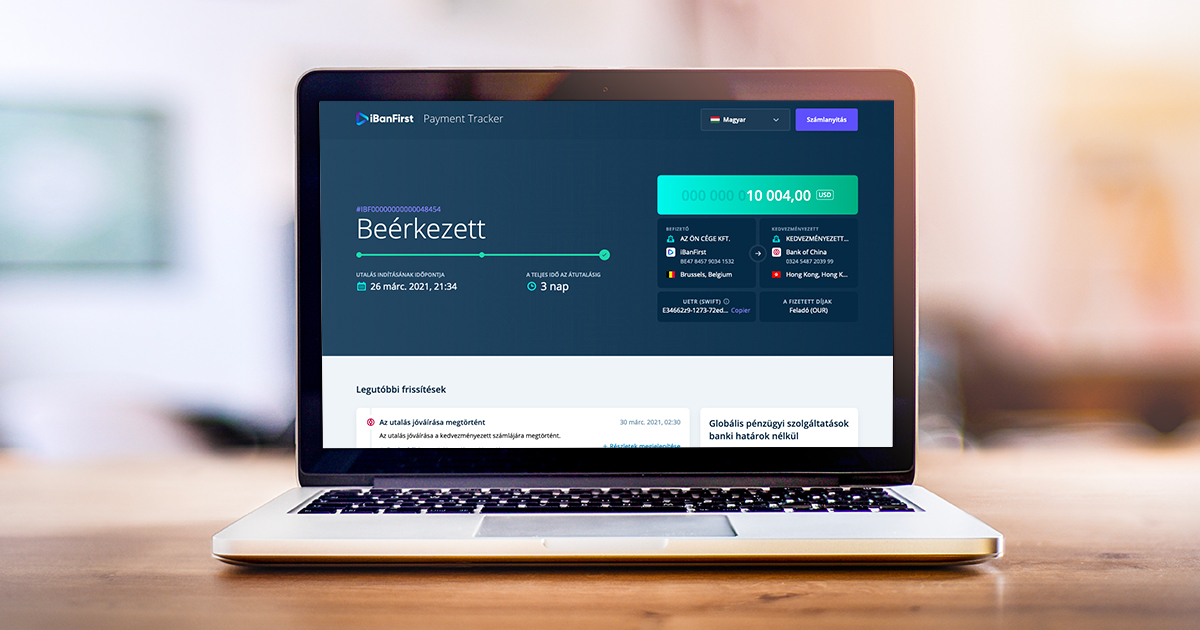

IBanFirst, one of the largest European online platforms for international payments for SMEs, received a license from the National Bank of Hungary (MNB) which will allow its local office to provide its business clients with fast, cost-effective, secure transactions in over 30 currencies and hedge their foreign exchange risks, the company tells the Budapest Business Journal.

For iBanFirst, this accreditation represents a consolidation of its presence in Central and Eastern Europe, one of the most dynamic regions for the FX market.

“We have been working with Hungarian companies for the last 5 years, and we can definitely say that it has been one of the most dynamic markets for us and a success story for the region. We are therefore happy to have a fully-fledged office, accredited by the Hungarian National Bank which enables us to support Hungarian companies thrive internationally by providing easier, faster, and more transparent international payments as well as hedging solutions,” said Pierre-Antoine Dusoulier, founder & CEO of iBanFirst.

In 2022, the Hungarian clients of iBanFirst conducted more than 30,000 international transfers to 69 countries. Nearly 40% of transfers were completed within just 2 hours – whereas, with domestic banks, this process can take several days, the company explains. The main trade partners for Hungarian companies are located in EU, China, and Turkey.

Currency risk management services, including hedging represented around 30% of the total revenue in the past year.

The company has already developed a local team of FX specialists and a solid boutique portfolio of Hungarian clients. The target of the local office is to reach 600 clients by the end of the year. Each client benefits from a dedicated account manager and regular meetings with the team.

“The company has a new product in the pipeline for the Hungarian market, which will expand its multi-currency payments offering for small and medium enterprises (SMEs). The new product will enable businesses to open local currency accounts in the U.S. through iBanFirst. Some of the fastest developing Hungarian technology and software companies make up a large part of clients with a potential interest in this service,” said Johan Gabriels, regional director of iBanFirst.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.