Workers Look to Keep Existing Jobs Amid Gloomy Fall News

At the start of last month, the Hungarian government received some news that was probably accompanied by a great sigh of relief: Moody’s Investors Service affirmed the “Baa2” rating for Hungary, maintaining a “stable” outlook on Sep. 1.

Moody’s praised “the availability of skilled workers, one of the highest wage-adjusted labor productivities among EU countries, a solid infrastructure, one of the lowest corporate income tax rates among EU countries and its integration into European manufacturing production networks.”

Among other positive factors, Hungary is coping with a “moderately high” debt burden, while the “economic strength is expected to remain robust in light of significant investments.” Moody’s expected Hungary to “ultimately receive most EU funds in a noisy, step-by-step process so that the impact from a delayed flow of EU funds on economic growth and public finances will be limited.”

The big question is how GDP growth will develop, and here, Moody’s expects stagnation this year, with expansion to resume next year at 3%, driven by a recovery of the domestic economy and exports. Private consumption will benefit from real wage growth turning positive as consumer price inflation decelerates. So, there is much good news in Moody’s rationale and, more importantly, positive outlooks for the future. The present, however, remains grim.

On the same day Moody’s rating news was released, Hungary’s Central Statistical Office (KSH) published the Q2 figures, reaffirming the preliminary data of a decrease in GDP growth of 2.3%, the worst since 2020.

Industrial output fell by 5.7%, construction output by 6%. Farm output saved the figures from an even worse performance, as agriculture grew by 67.9% in annual terms due to favorable weather conditions this spring. Commerce registered a 12.6% shrinkage, tourism and hospitality were down 2.9%, and logistics by 6.2%.

10-month Cycle

Household consumption decreased by 1.6%. According to other KSH statistics, the real wage decrease has been continuous for 10 months in Hungary. Analysts estimate that internal consumption will not start growing in the next two quarters.

This is sustained by the solvency index (IFI) report released in early August by Intrum and GKI. The index summarizes the financial security of households in a single figure, factoring in income, the volume of loan debt, the value of savings, as well as the cost of living.

Compared to the first quarter, the IFI slightly improved in Q2, to 11.06 points from 6.51. However, it is still well behind compared to Q2 2022, when it stood at 35.33 points. Growth is hindered by inflation and stagnating wages, the report says.

If so, what caused the IFI growth from Q1 to Q2 this year? Judit Üveges, sales director at Intrum, says that the load debt component of IFI is the explanation. Households stopped taking out loans and concentrated instead on repaying existing ones. So, they are not spending more; on the contrary, consumption fell by 2.5% in Q1, and more is expected this year as families dip into their savings. Moreover, it seems that some have already depleted these, given that new loans are mainly directed to finance daily expenses, Üveges explains.

Other data confirms these findings. A survey conducted by workforce placement firm Trenkwalder indicates that among employees working at private companies, almost half (48%) are unsatisfied with their salaries and two-thirds (62%) feel their financial situation is worsening. Meanwhile, employers seem unable to address the dissatisfaction: only 28% of respondents said their company had raised their salary during the current year to compensate for inflation.

Trendkwalder also inquired how much higher salary would be required for employees to leave their current jobs. Two-thirds would do so for 30% more. But this is an unlikely situation, as demand for workers dropped this year, significantly limiting employee bargaining opportunities. Hence, the high rate (73%) of those who prioritize keeping their job rather than focusing on a salary raise.

Rollercoaster Confidence

A growing number of employees (53%) also feel that this year it is harder to find a job matching their profession, up from 45% last year. Other outlooks are not better, either.

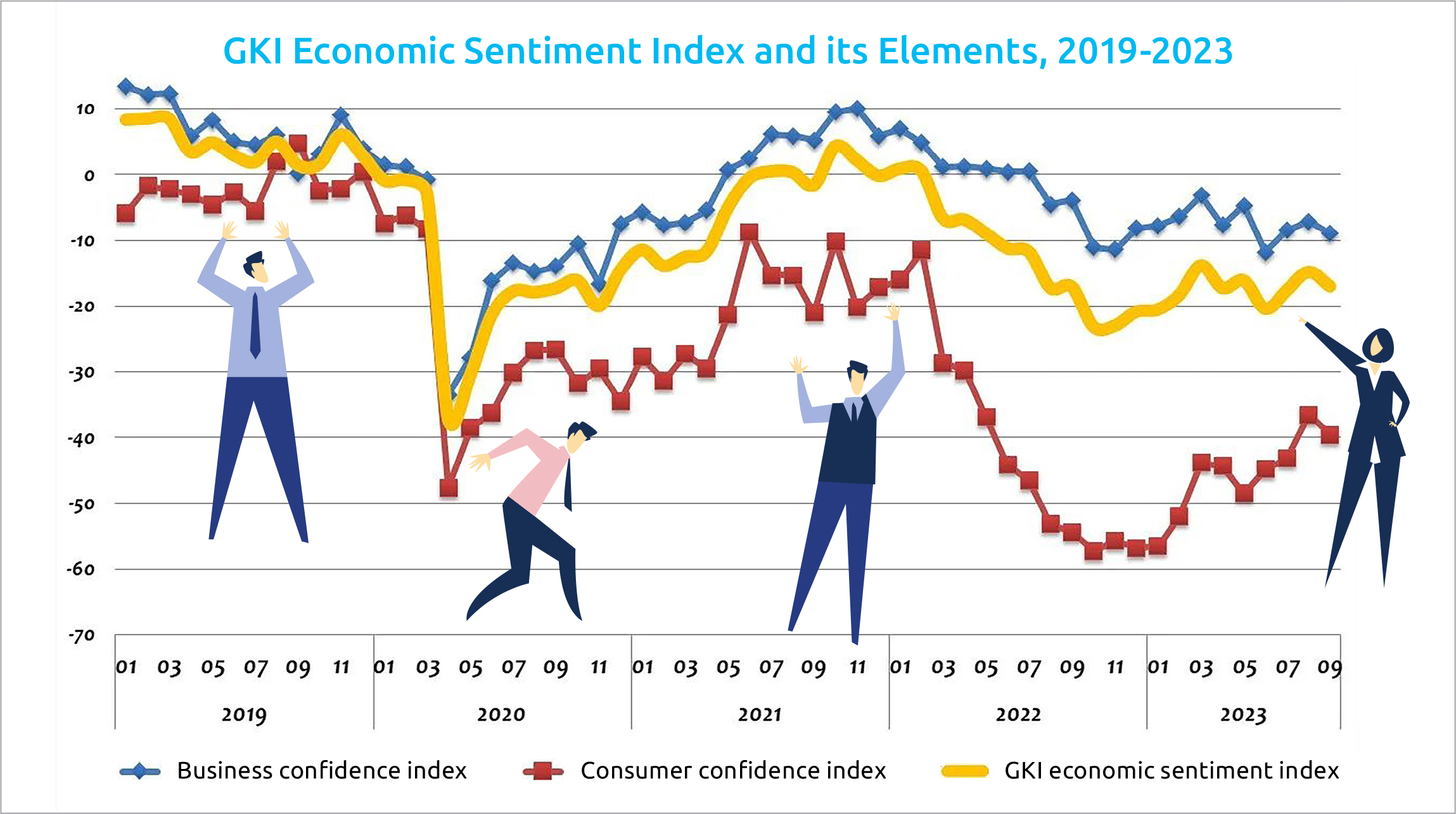

In August, the GKI consumer confidence index reached a 16-month peak. “Both the assessment of own financial position over the past 12 months and expectations for the next 12 months improved substantially. The perception of money that can be spent on high-value consumer goods also became more favorable,” GKI said at the time.

One month later, the party was over. In September, the index fell by three points. “Households assessed their own financial situation in the past 12 months as worsening compared to the previous month and had a similar view for the next 12 months. Households’ perception of their ability to spend money on high-value consumer goods over the next 12 months also deteriorated slightly,” GKI wrote.

In a separate analysis released on Sep. 21, GKI made forecasts for the economic environment this year and next. For 2023, GKI expects real earnings to fall by 1.5-2%, but by the end of this year, they could grow substantially in the private sector.

Next year, however, three “major dilemmas” will shape the labor market: the treatment of the 2023 real earnings decline, the credibility of the government’s 2024 inflation forecast, and the acceptability to workers of a modest real earnings increase on average across the economy that does not threaten to restart the wage-price spiral.

“If the government were to advocate 6% in wage negotiations, it is possible that the minimum wage increase would be close to 10%, even in the face of employer opposition,” GKI estimates. If everything goes well, including economic productivity, real income and consumption could grow by around 2%, according to the GKI forecast.

This article was first published in the Budapest Business Journal print issue of October 6, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.