Reading the Real Estate Crystal Ball for 2024

After an economically turbulent 2023, what’s in store for the real estate business in 2024? Senior Colliers experts Kristóf Tóth (head of research), Bence Vécsey (head of capital markets), Miklós Ecsődi (head of office) and Tamás Beck (head of industrial) detail the most critical factors likely to affect the Hungarian real estate market this year.

In terms of the real estate investment market, last year saw a 27% decline in investment transaction volumes compared to 2022. The cost of capital has increased, and it is challenging to make returns in the region more attractive compared to Western European countries. The expert team says there is still a wide gap between buyers’ and sellers’ expectations, and rental markets are weakening.

“2022 was a weak year already, and the numbers kept falling compared to a low base. The number of deals plummeted,” notes Bence Vécsey.

He also says that the balance of Hungarian and foreign investors shifted significantly compared to the 50:50 ratio in place until about 2016; 90% of investments made in 2023 were Hungarian.

“We expect this to change, to get better. We are competing on a regional level; investors tend to look at regions like CEE as a whole. Still, a price correction needs to happen, and financing costs need to decrease,” he adds, forecasting a slow recovery in the real estate investment market from the second half of 2024 and into 2025.

Macroeconomic Trends

Looking at the underlying macroeconomic trends, 2023 saw a decline in GDP and industrial production. There were, of course, some areas that went in the opposite direction, such as automotive and electrical components, which managed to maintain their growth trajectories. The high inflation rate continued its rapid decline throughout 2023, driven by downward base effects and lower energy prices.

“We can expect 3-4% growth to return in 2025, which could boost the tenant side a little bit. On the other hand, there are no changes expected to unemployment, which means that the tight labor market is here to stay,” says Kristóf Tóth.

Construction output declined by 5.3% in the first 11 months of 2023. Falling government and private investment, changes in commodity prices and the EUR/HUF exchange rate played a significant role in moderating construction output price dynamics, Tóth noted.

On a more negative note, lower disposable and negative real income led to a marked decline in retail sales. Total retail sales and sales volumes in the clothing and footwear segments fell by 8.7% and 7.9%, respectively, in the first 11 months of the year. E-commerce declined by 5.4% in the year to the end of November. Looking ahead to 2024, however, the retail sector is expected to expand as disposable income increases.

Changing Office Priorities

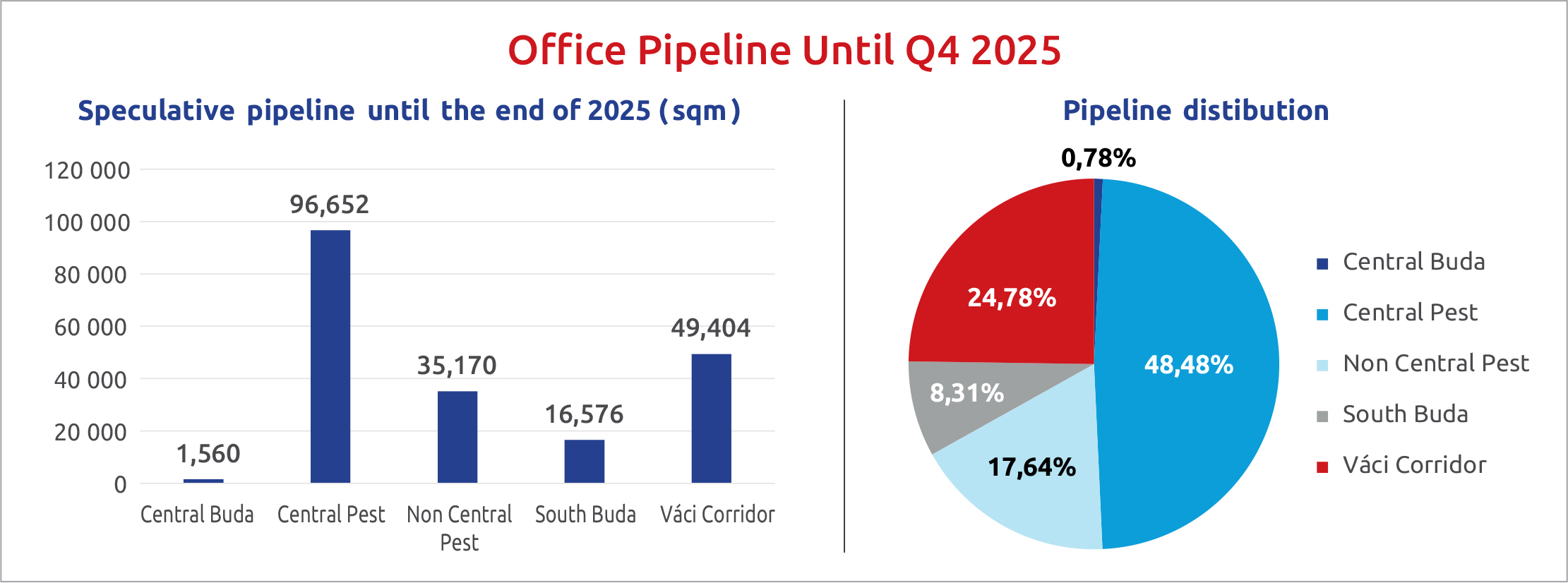

In the office market, Colliers predicts rising vacancy rates. However, there is still a noticeable demand for modern, well-located buildings that meet ESG guidelines, and there is a good reason behind this trend, according to Miklós Ecsődi.

“COVID and the rise of remote working forced companies to rethink their office concepts, with priorities shifting away from office spaces with focus on individual work to more coworking areas. We can expect the most moves from companies currently residing in older category ‘B’ office buildings,” he argues.

The total modern office stock in Budapest currently stands at 4,369,900 sqm, including 3,571,710 sqm of modern speculative office space in categories “A” and “B” and 798,190 sqm of owner occupied office space. Total gross demand in 2023 was 575,504 sqm, while net demand over the same period was 290,082 sqm. Both gross and net occupancy showed a 47% increase compared to 2022.

The vacancy rate reached 13.3% in the fourth quarter of 2023. The rate increased by 0.1 of a percentage point compared to the previous quarter and by 2 pp compared to the same period last year.

In the last quarter of 2023, the lowest vacancy rate was recorded in the North Buda submarket (8.7%), while the highest rate, unchanged, was in the agglomeration (36.8%). Although net absorption moved into positive territory during the fourth quarter, the total amount of office space in use decreased by 4,428 sqm across the whole of 2023.

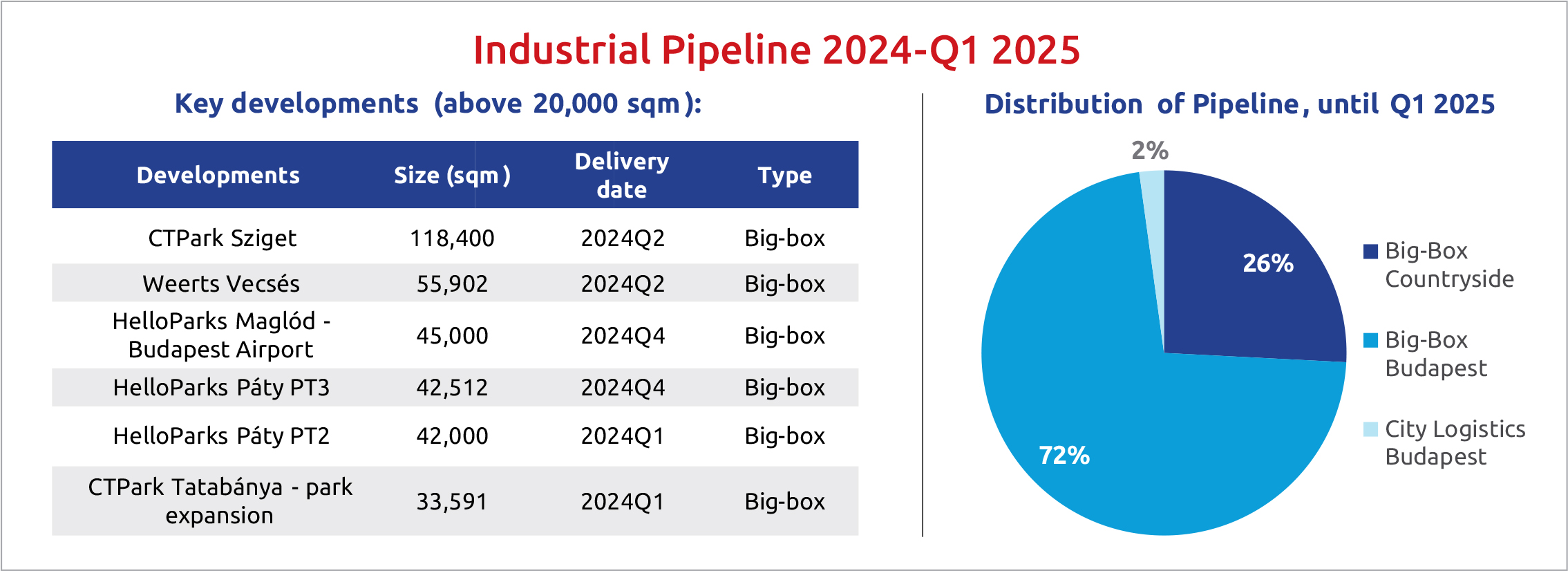

Budapest vs Countryside

The industrial real estate market has seen positive net absorption, with an increase in vacancy compared to 2022, while also showing a healthy pipeline. At the end of 2023, the total national modern industrial/logistics stock stood at 5,090,570 sqm.

Of this, 3,487,830 sqm is located in and around the capital, while the regional domestic stock is 1,602,750 sqm. The annual new supply volume in and around the capital reached 358,010 sqm, while it was 159,800 sqm in regional markets. But why is Budapest so far ahead of the countryside in terms of logistics real estate projects with all the new factories appearing in the country?

“You have to look at the country’s size and the structure of its transportation routes, which is different from that of Romania or Poland,” Tamás Beck explains. “You can drive 200 km from Budapest and practically ‘fall off the map.’ That’s not a huge distance for trucks,” he adds. The nearly three million people living in the Budapest agglomeration remains a considerable labor market draw compared to the next largest city, Debrecen, which has fewer than 250,000 inhabitants.

At the end of Q4 2023, a total of 298,560 sqm of industrial/logistics space was vacant in the market around Budapest. In the regional domestic speculative real estate stock, 91,310 sqm of vacant space was recorded, corresponding to a vacancy rate of 5.7%. The national vacancy rate is currently 7.7%.

Editor’s note: The Colliers experts were speaking at an exclusive breakfast event the consultancy held in its offices on Jan. 25, looking at the domestic commercial real estate market, trends, and current expectations for 2024.

This article was first published in the Budapest Business Journal print issue of February 23, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.