Disinflation Continues, but not for Long

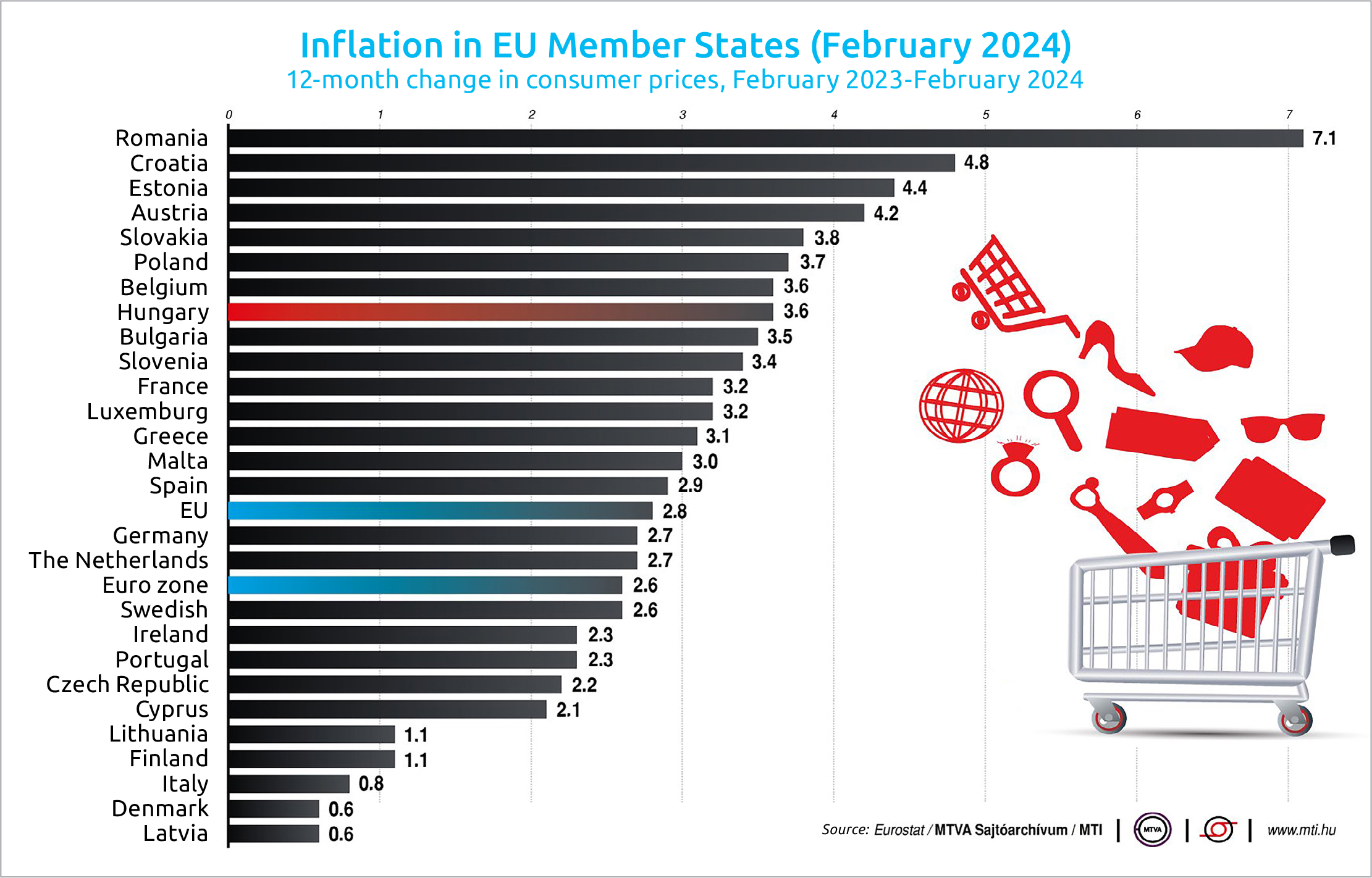

Inflation slowed further in February, remaining in the central bank’s 2-4% target band. However, analysts warn that the generally favorable inflation picture cannot be maintained in the long term.

Inflation in Hungary continued its downward trend, standing at 3.7% in February. Compared to the same month last year, a price increase of 2.2% was recorded for food, according to the latest report released by the Central Statistical Office (KSH). Electricity, gas and other fuels became 9% cheaper, service prices went up by 10%, while alcoholic beverages and tobacco prices rose by 5.3% on a year-on-year basis.

From the previous month, prices were up by 0.7% on average. Food became 0.2% more expensive on average, while electricity, gas and other fuels became 0.6% more expensive. In the latter group, motor fuels were 6.7% more expensive.

Analysts were surprised by the better-than-expected February inflation data, but many are warning of the possibility of reflation due to the repricing of services.

According to ING senior analyst Péter Virovácz, February saw a slowdown in the previously extremely fast disinflation, as the consumer price index rose by only 0.1 of a percentage point to 3.7%, compared to January. Although this was close to ING Bank’s preliminary expectations (3.9-4%) and to the consensus of 3.9-4% on an annual basis in the market, the data can be evaluated as a small positive surprise.

In his outlook, Virovácz emphasizes that the monthly exchange rate will probably be slightly weaker in the next period, and the annual consumer price index will be around 3.3-3.5%.

He points out that the inflation in the cost of services may still be the most significant driving force, and the rise in fuel prices may further strengthen the monthly repricing. However, the generally favorable inflation picture cannot be maintained long-term, and ING still expects two rounds of reflation.

Downside Risk

According to Virovácz, the first round is expected in May, with the second in October. As a result, ING’s inflation forecast for December 2024 is in the range of 5.5-6% and currently closer to the top end of the range. For the second half of the year, however, the analyst sees downside risks in the inflation outlook due to the weakness of economic performance, the easing of labor market tightness, and the slight improvement in consumer confidence.

The better-than-forecast CPI data creates a complicated situation for the Hungarian National Bank (MNB); if it persists with 100 basis point interest rate cuts, support for the forint exchange rate may weaken.

According to Péter Kiss, investment director of Amundi Fund Management, the lower-than-expected February inflation data will strengthen the MNB in continuing to cut interest rates. However, the phasing out of the base effects and a euro-forint exchange rate of nearly 400 might complicate the situation.

Kiss says the interest rate cuts may continue at a rate between 75 and 100 basis points, with a mid-year inflation target of 6-7%.

The stability of the capital markets and the European Central Bank’s statements referring to an interest rate cut favor the larger 100 basis points cut. However, by the middle of the year, due to the continuously decreasing domestic interest rate and the stagnation of the European base rate, Kiss believes support for the exchange rate may weaken.

Orsolya Nyeste, Erste’s chief analyst, emphasized that the core inflation rate had slowed, which is a positive surprise. Food prices rose slightly, and with the decrease in fuel prices contributed to the reduction in the inflation rate. The cost of clothing fell while services rose in price.

“We continue to expect the current rapid disinflation to peter out in the spring. In the coming months, the annual reference rate should be between 4-5.5%,” says Nyeste.

Budget Consolidation

According to her, the expected improvement in internal demand and the strong need for some kind of budget consolidation may cause additional inflation risks in the second half of the year. Erste Bank expects the inflation rate will stabilize consistently within the MNB’s tolerance limit only in 2025.

According to the Ministry of National Economy, however, the government has already won the battle against inflation. As Minister of National Economy Márton Nagy wrote in a press release, the significant decrease in inflation is due to the targeted and effective measures of the government.

The minister said the introduction of the online price monitoring system and mandatory promotions supported the continuous moderation of inflation. He emphasized that real wages have been rising since September and that the minimum wage and guaranteed minimum wage increases in December, as well as the teacher wage increase and the general wage dynamics, may further strengthen this trend.

In light of persistently low inflation and reasonable wage offers, a real wage increase of 5-6% is expected in 2024, according to the minister. Having successfully suppressed inflation, the government is now focusing on the main challenge of 2024, restoring economic growth. For this, it is necessary to increase the mobilization of domestic labor reserves further, encourage a high investment rate, and restore household consumption by strengthening consumer confidence and removing caution, Nagy claims.

Indeed, the minister recently admitted at a conference that this year’s 4% growth target is unrealistic. This was the first acknowledgment by the Minister of National Economy that the original macroeconomic target of the 2024 budget is no longer tenable.

This article was first published in the Budapest Business Journal print issue of March 22, 2024.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.