Government retreats from war on public debt

The government is slackening what has long been one of its core principles of constantly paying off debts seeing it would constrain its budgetary space and would also limit its options ahead of the 2014 general elections.

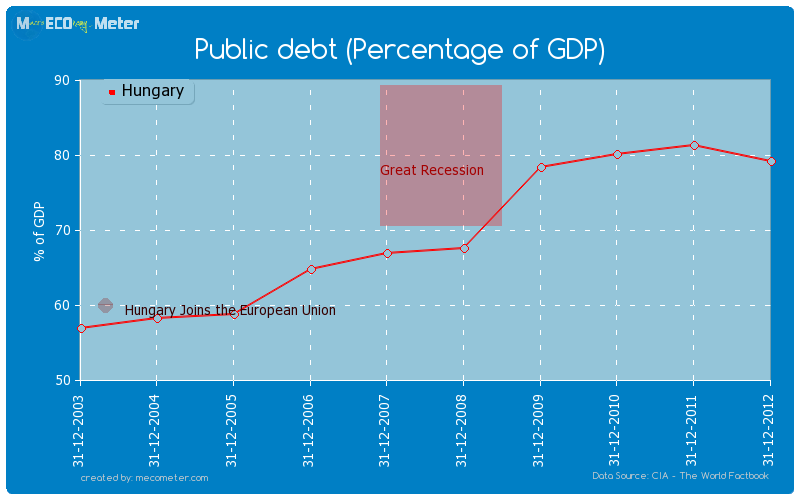

Just as the government is loosening its commitment to keeping the budget deficit at 2.7% of gross domestic product this year, Hungary’s aggregate public debt amounted to 81.4% of GDP in the second quarter, rising more than 2% from the end of last year.

The situation, aggravated by the government’s shopping spree – and the national system’s continued habit of hemorrhaging money – necessitated not only seven revisions to the annual budget, but will also require revising another “bedrock solid” law that was meant to assure the uninterrupted reduction of the country’s debts.

The Economic Stability Act passed in December 2011 dictates that Parliament may only ratify annual budgets that contain debt figures lower than the level of the year when they are passed until the level drops below 50% of GDP. In theory, this was to bind all governments in the future to reduce the level of indebtedness, something Prime Minister Viktor Orbán proudly declared as one of the principles he was happy to tie future governments to. Now, this is also going to the wind.

Futile campaign

The only major success the government can showcase in debt reduction was when PM Orbán announced in the summer of 2011 that HUF 1.1 trillion of the nearly HUF 3 trillion in nationalized private pension funds would go to debt payoffs. The move took debt down to 78.5% of GDP.

After that, the level was higher in every quarter leading to criticism of the government, not only for the questionable means and reasoning behind the confiscation of the pension wealth, but also because it seemingly squandered what is almost 4% of the country’s GDP without anything to show for it or the populace in any way benefitting.

Realizing that the debt reduction department isn’t delivering the desired results, the Economy Ministry decided to discontinue an application on a government website that measured the level of public debt at any given time, citing maintenance costs. The ministry also revised its practice of issuing regular information about public debt to give the media and their audiences less information.

More to come

The year is far from over and the debt total is set to rise. Economy Ministry state secretary Gábor Orbán announced that the fall would be the best period to seek out additional funding for the country: “I believe the state debt management agency ÁKK should hold another dollar bond issue on the international market within the year,” he said.

ÁKK has already conducted one issuance this year, selling $3.25 billion in paper in February. The move is necessitated by the government’s zeal to repay the loan from the International Monetary Fund taken out by a previous socialist administration in 2008 and which cut into reserves.

ÁKK’s deputy chief executive László Borbély later added that issuing bonds in the autumn is the smartest tactical move since the country can secure the most beneficial long-term financing to repay foreign currency debt that matures in January.

True to its plans, Hungary has signaled its intent to the U.S. Securities and Exchange Commission to issue $5 billion in bonds in one or more rounds.

“This is a big number,” said Standard Bank analyst Timothy Ash in a comment.

Ash noted that the move would make Hungary’s credit levels one of the highest in the region behind Russia and Turkey and speculated that the move may be linked to government ambitions to increase state ownership on the energy market.

The sector is already a prominent entry on this year’s spending commitments with the government deciding to buy the natural gas interests of Germany-based utility giant E.ON in Hungary for HUF 71 billion and there is another HUF 100 billion earmarked for the Takarékbank savings cooperative.

The government has also made an offer to buy troubled steelmaker ISD Dunaferr to forego thousands of layoffs and is still interested in expanding the role of the state in the economy through acquisitions as opportunities arise.

The governing Fidesz party is obviously looking at political aspects as well with the coming general election in 2014. The government has already decided on a salary boost to educators and analysts are expecting more measures as the 2014 annual budget is being drafted.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.