BUX up in correction of correction

The Budapest Stock Exchangeʼs main BUX index finished up 1.48% at 21,642.72 Monday after diving 2.62% Friday. It is up 30.11% from year-end, after losing 10.40% last year. It ended last week down 4.06% from its latest nearly four-year closing high at 22,230.10 last Monday, but still up 0.83% on the week.

The Budapest parquet corrected up from last weekʼs steep downward adjustment from earlier highs, encouraged by European and Russian markets that rose on Chinese monetary stimulus news and word from the IMF that talks with Greece gained some momentum over the weekend.

Chinaʼs central bank on Sunday cut banksʼ reserve requirement.

Local worries did not ease, especially for new burdens on banks in connection with raised mandatory compensations to clients of several Hungarian brokerages that collapsed since February, but traders pointed to the next policy meeting of the National Bank of Hungary (MNB) on Tuesday which is widely expected to cut the base rate further as cause for some optimism in the share market.

The forint also corrected a sharp fall last week, but the policy rate outlook kept the Hungarian currencyʼs strengthening against the euro limited, fostering hopes that the exchange rate will not threaten export competitiveness.

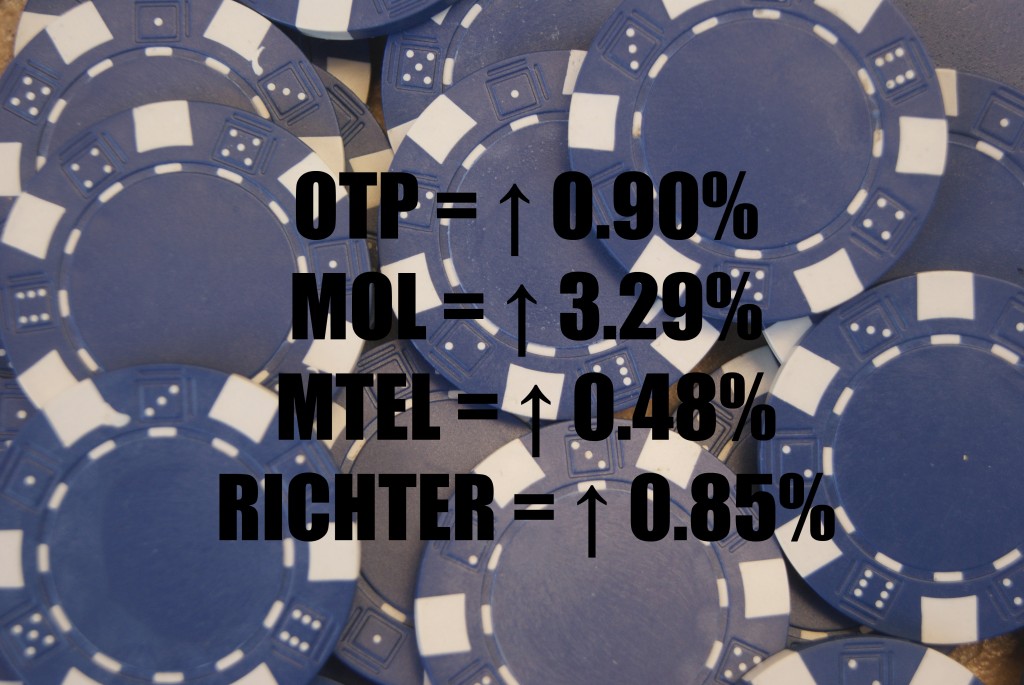

OTP recuperated 0.90% from a plunge of 3.35% on Friday, to HUF 5,620 on turnover of HUF 3.86 bln from a HUF 6.87 bln session total, two-thirds of the daily average this year.

MOL rose 3.29%, offsetting its 2.53% drop on Friday, to HUF 14,900 on turnover of HUF 1.84 bln.

Magyar Telekom gained back 0.48% from a fall of 2.34% on Friday, to HUF 420 on turnover of HUF 150 mln.

Richter advanced 0.85% after a retreat of 2.14% on Friday, to HUF 4,145 on turnover of HUF 905 mln.

The bourseʼs mid-cap BUMIX went out 0.71% higher at 1,586.77. Elsewhere in the region, WIG 20 in Warsaw was up 1.69%, while Pragueʼs PX garnered 0.26%.

Western Europeʼs major indices were all up ahead of their close Monday, FTSE-100 in London 0.69%, DAX30 in Frankfurt 1.61%, and CAC40 in Paris 0.71%.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.