BUX down on ruble, local outlook

The Budapest Stock Exchange's main BUX index finished down 0.82% at 16,530.93 Friday after dropping 1.48% Thursday. It is down 0.62% from year-end, after losing 10.40% last year. A surprise deep rate cut by Russia's central bank pushed the Hungarian parquet further down as the Russian ruble fell against major currencies and against the forint as well. Most Hungarian blue chips are strongly exposed to Russian markets.

On the macro front, National Bank of Hungary (MNB) statistics showed corporate lending still anaemic with lending stock at the end of December up 0.7% from the end of 2013 mainly on the MNB's Lending for Growth Scheme for SME's, but still down 2.4% from the end of 2012 and down 12.9% from the end of 2011.

Banks' household lending stock, a proxy indicator of private spending propensity, fell 1.7% to end of last year from end-2013, and was down 7% from the end of 2012, and down 20.9% from end-2011. Forex loans made 53% of the total at the end of last year, down from 65% at end-2011.

Forint household lending stock grew 0.7% from the end of 2013. It was down 0.3% compared to end-2012, and up 5.6% from end-2011.

Other statistics out on Friday showed annual producer price inflation slowing to 0.1% in December from 0.6% in November while odds that the central bank could help with a rate cut diminished lately.

MOL wobbled in last-minute trades after a boost for the day from rising oil prices, and a hint by the prime minister at concluding a new gas supply agreement with Russia in February when Russia's president visits Hungary.

UniCredit cut MOL's target price by 14% to HUF 11,330 which is still higher than its present course. UniCredit kept the recommendation to hold.

OTP was unfazed after Hungary's prime minister reiterated commitment to cut the special bank levy as soon as the economy improves but no sooner than next year as it was not the first time the government flashed the idea of a cut with strings attached but with no near action in sight, analysts said.

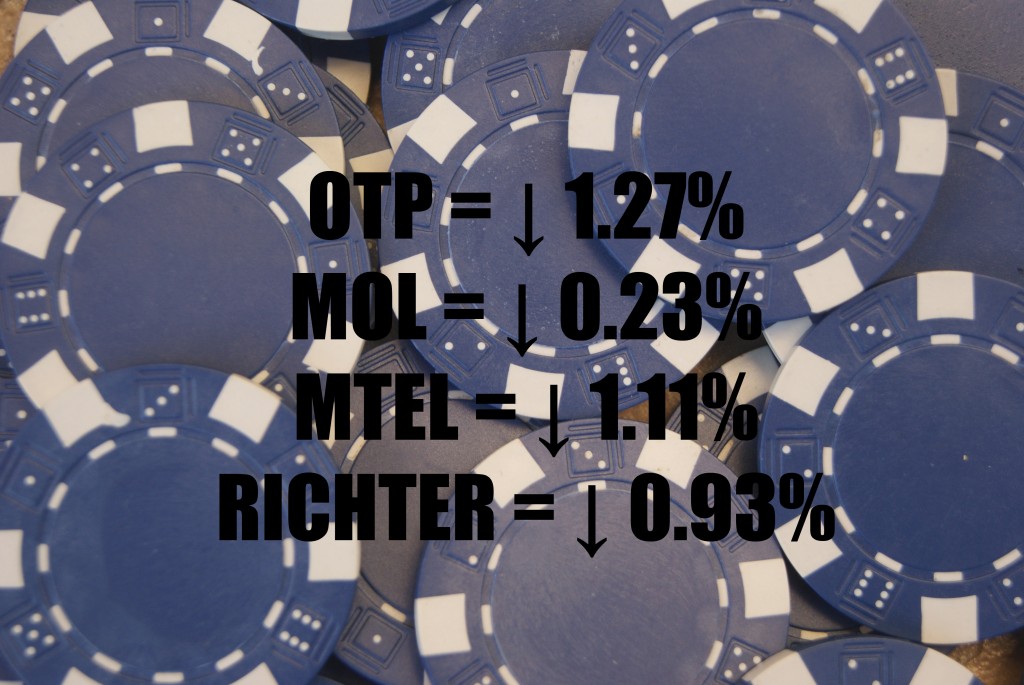

OTP lost 1.27% to HUF 3,650 on turnover of HUF 5.73 bln from a HUF 8.11 bln session total, about 4% more than the daily average last year, and about 15% above the average this month.

MOL fell 0.23% to HUF 11,055 on turnover of HUF 691m.

Magyar Telekom dipped 1.11% to HUF 357 on turnover of HUF 452m.

Richter retreated 0.93% to HUF 3,740 on turnover of HUF 1.16 bln.

The bourse's mid-cap BUMIX went out 0.10% lower at 1,422.79.

Over the week, the BUX fell 1.36% after rising 6.37% in the previous week.

OTP was down 3.41% after soaring 6.33% last week.

MOL dropped 1.38% after gaining 4.57% the previous week.

Magyar Telekom rose 2.59% after shooting up 6.42% last week.

Richter fell 0.93% after a gain of 9.58% over the previous week.

Average turnover in January, HUF 7.00 bln, was a tenth above last year's average.

The BUMIX was down 0.95% over the week after rising 2.06% last week.

Elsewhere in the region, the WIG 20 in Warsaw was up 0.01%, while Prague's PX raked up 0.14%. Western Europe's major indices were all down ahead of their close Friday, FTSE-100 in London 0.74%, DAX30 in Frankfurt 0.75%, and CAC40 in Paris 0.89%.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.