BUX down, but Germany, monetary policy hopes support

The Budapest Stock Exchange's main BUX index finished down 0.20% at 16,918.99 Wednesday after rising 0.36% Tuesday. It is up 1.71% from year-end, after losing 10.40% last year.

Before quick profit taking as well as wins narrowing in the very final seconds of trade, the Budapest parquet rose for the whole day after the German government upped its official GDP growth projection for Germany for this year. Germany is Hungary's largest trading partner and the biggest source of foreign direct investment.

Mood in the marketplace also reflected expectations for the National Bank of Hungary (MNB) expanding its zero rate loan refinancing programme, the Funding for Growth Scheme designed for SMEs, and extending it to large firms as well, as its governor said on Sunday.

MOL was supported by hopes that it could later clinch some business related to a new gas pipeline project from Russia through Turkey to Europe which seems to take the place of the South Stream plan withdrawn by Russia late last year, analysts say. Russia's president is due to visit Hungary in the middle of February.

As Hungarian blue chips are much exposed to Russian markets, Wednesday's strengthening of the Russian rouble against both the euro and the Hungarian forint helped, while Richter also rode the wave of the latest news on the success of a clinical drug trial and a distribution agreement with Bayer, which would bolster the company's access to Western markets.

OTP's loss deepened towards the end of trade on the fresh Greek-eurozone animosities pressuring bank shares all over Europe.

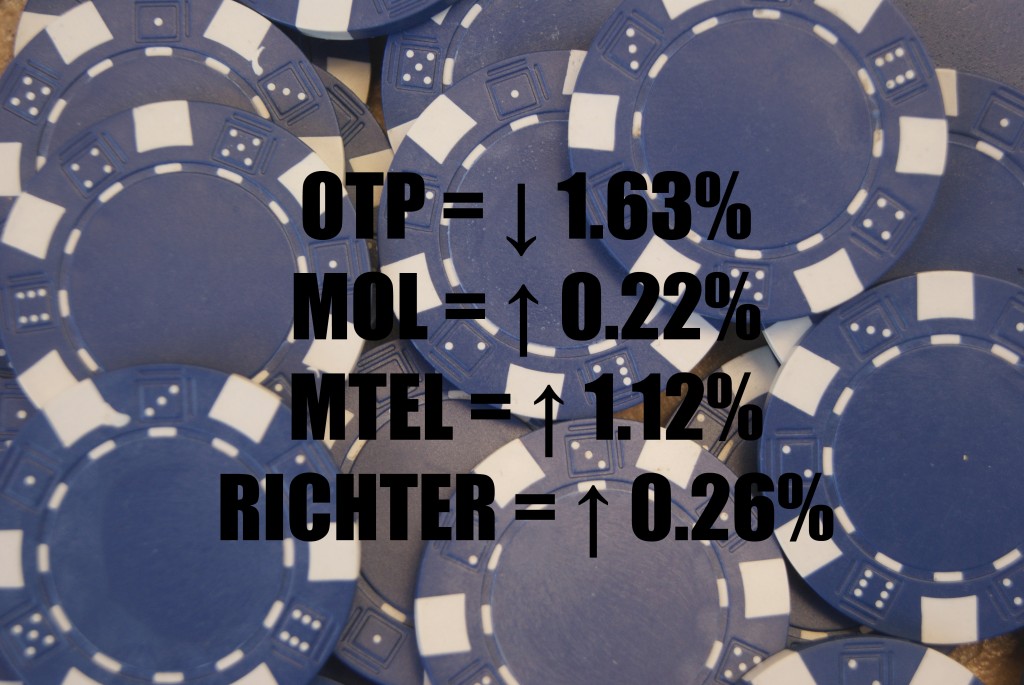

OTP lost 1.63% to HUF 3,733 on turnover of HUF 2.99 bln from a HUF 6.26 bln session total, a fifth short of the daily average last year, but broadly in line with January average.

MOL won 0.22% to HUF 11,325 on turnover of HUF 791 mln.

Magyar Telekom rose 1.12% to HUF 362 on turnover of HUF 427 mln.

Richter advanced 0.26% to HUF 3,860 on turnover of HUF 1.96 bln.

The bourse's mid-cap BUMIX went out 0.74% higher at 1,422.74.

Elsewhere in the region, the WIG 20 in Warsaw was up 0.40%, while Prague's PX fell 1.48%. Western Europe's major indices were mixed ahead of their close Wednesday, FTSE-100 in London down 0.14%, DAX30 in Frankfurt up 0.44%, and CAC40 in Paris down 0.61%.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.