Bill would amend state debt threshold, could eliminate ad agencies

Hungary’s National Economy Minister Mihály Varga yesterday submitted a bill to Parliament that would amend a rule on a nominal state debt threshold to prevent negative consequences for economic growth, Hungarian news agency MTI reported. The bill was submitted after the Fiscal Council noted that the governmentʼs 2016 budget draft failed to comply with the rule and the recommendation was to amend or scrap it.

The bill also seeks to cut out the “middle man” from the advertising market by prohibiting ad agencies from establishing contractual relationships with media companies and excluding payment of bonuses, as according to the bill, such bonuses, which can account for 5-20% of all ad revenue, are "harmful since they have a distorting effect on the market". This measure could eliminate ad agencies in Hungary.

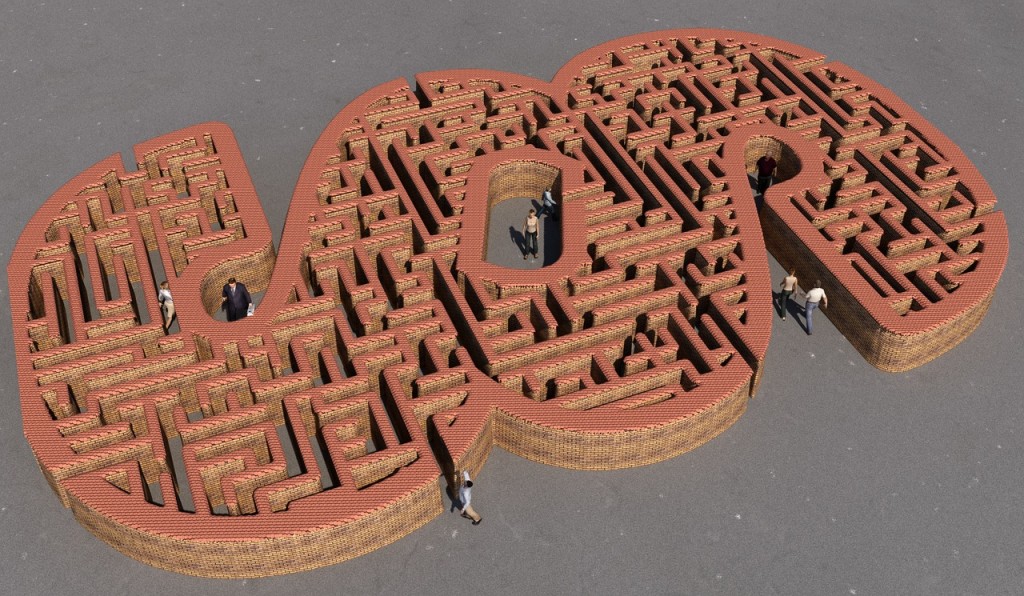

The Fiscal Council said earlier in May that Hungaryʼs year-end state debt as a percentage of GDP, calculated at unchanged exchange rates, will continue to decline next year, as required by law, however complying with another legal requirement – in force for the first time with the 2016 budget – limiting the nominal increase in state debt to half of the difference between projected inflation and real GDP growth would require a HUF 700 bln correction.

According to the Fiscal Council, complying with the rule would limit the increase in nominal state debt to just 0.35%, while the budget draft targets a 3.3% increase, the Council explained. The bill submitted yesterday would apply the rule only when inflation exceeds the 3% National Bank of Hungary mid-term target and GDP growth is over 3%, MTI said.

The bill would also change the date for introducing a flat-rate corporate tax in the Economic Stability Act from January 1, 2016 to the start of 2020. "The later introduction of the flat-rate corporate tax causes no significant disadvantage to economic players," the bill states. At present, Hungarian companies pay a 10% rate on a tax base of up to HUF 500 mln and a 19% rate thereafter, MTI added.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.