Sustainability Central to High-end Investment Deals

The Budapest One development by Futureal has both Well and Breeam accreditation.

In addition to a market correction, with yields moving out from the current 5.25% for office and 5% for industrial, the other major ongoing issue for the investment market is the need for both purchasers and vendors to conclude deals based on ESG criteria in accordance with the EU Taxonomy.

This is particularly the case with investors seeking core product with international tenants and carbon-neutral goals and currently less so concerning value-add acquisitions.

The importance of ESG will keep growing for investors and occupiers in 2023 and become a more critical element in the pricing of assets, says Benjamin Perez-Ellischewitz, principal at Avison Young Hungary.

“ESG investing (the integration of environmental, social and governance factors into the acquisition and exit process) is increasingly a concept and code of practice that has been adopted by investors as a central part of their investment strategies, due to pressure from shareholders and legislators and a wider need to be seen to be investing in a sustainable way,” says Perez-Ellischewitz.

“Investors obviously have yields and their return on investment as a central priority, although commercially successful investment-standard buildings tend to have attained sustainability accreditation, sustainability expectations are now obviously an integral element of the leasing process and asset management,” he adds. Others agree with that assessment.

“I would have to say that all aspects of ESG and EU Taxonomy are important, and our Colliers ESG specialists across the region are seeing greater demand for ESG/EU Taxonomy due diligence and reporting from investors and owners, alongside regular technical due diligence,” comments Kevin Turpin, head of CEE at Colliers.

Performance is Key

“Similarly, our new energy services team is also in high demand as energy efficiency and/or performance is key, along with the ability to demonstrate a building’s compliance or commitment. This may all potentially come with additional capex that needs to be budgeted or financed and therefore has an impact on the overall case for acquisition/profitability and eventual exit,” he notes.

“The level of importance of ESG and the EU Taxonomy to the various investor types will vary, depending on their individual commitments, reporting and related ability to raise debt and equity, amongst others,” Turpin adds.

In this way, developers and asset owners must include sustainability features in projects with a longer-term view of a possible exit strategy.

“On the cost side, there is a lot of room for improvement in sustainability that cannot be ignored today. We can say that those who develop with lower energy consumption will be more competitive in the market,” comments Noah Steinberg, chairman and CEO of Wing.

“This has always been a central issue for us because, at Wing, we are committed to creating sustainable buildings that go beyond the expectations of today’s world, respect the environment, or even contribute to improving the comfort of employees through people-centered services,” he says.

“Alongside the development and operational areas of sustainability, we now also have the areas of corporate governance and social guidelines, or ESG. Meeting these requirements will soon become a requirement rather than an opportunity, and investors will increasingly take this into account alongside growth potential,” Steinberg adds.

ESG, in general, requires a lot of comprehensive, transparent and traceable data monitoring. This is necessary for almost all stakeholders. Strategies and future actions can only be developed successfully if reliable data is available. Projects with elaborated and traceable ESG policies and reports will provide investors with enough confidence that the investment is of low financial risk, comments Zsombor Barta, founding partner at Greenbors Consulting.

High-end Need

The view among analysts is that ESG elements within any asset are currently more essential to high-end institutional investors than non-core or value-added investors.

“There are different expectations, and the perceived value of ESG compliance varies in some cases, but generally, investors that are after core products and international tenants with carbon-neutrality goals are only seeking assets that are fully in line with EU Taxonomy and generally high ESG standards,” says Máté Galambos, head of leasing at Atenor Hungary.

More opportunistic, value-add buyers will still go for first-generation assets with less favorable ESG attributes, he believes.

However, value-add acquisitions are being concluded with investors renovating and redeveloping historical buildings, especially, in line with sustainability accreditation. To give an example, the Europa Capital fund purchased what was the Akadémia Business Center in District V, in partnership with ConvergenCE as asset manager, and has undertaken a redevelopment of the Danube riverside building into the 10,500 sqm Academia office center.

“From the drawing board, we strived to combine our client-centric thinking and services with solutions that differentiate the Academia office center from the rest of the market,” says Csaba Zeley, managing director of ConvergenCE.

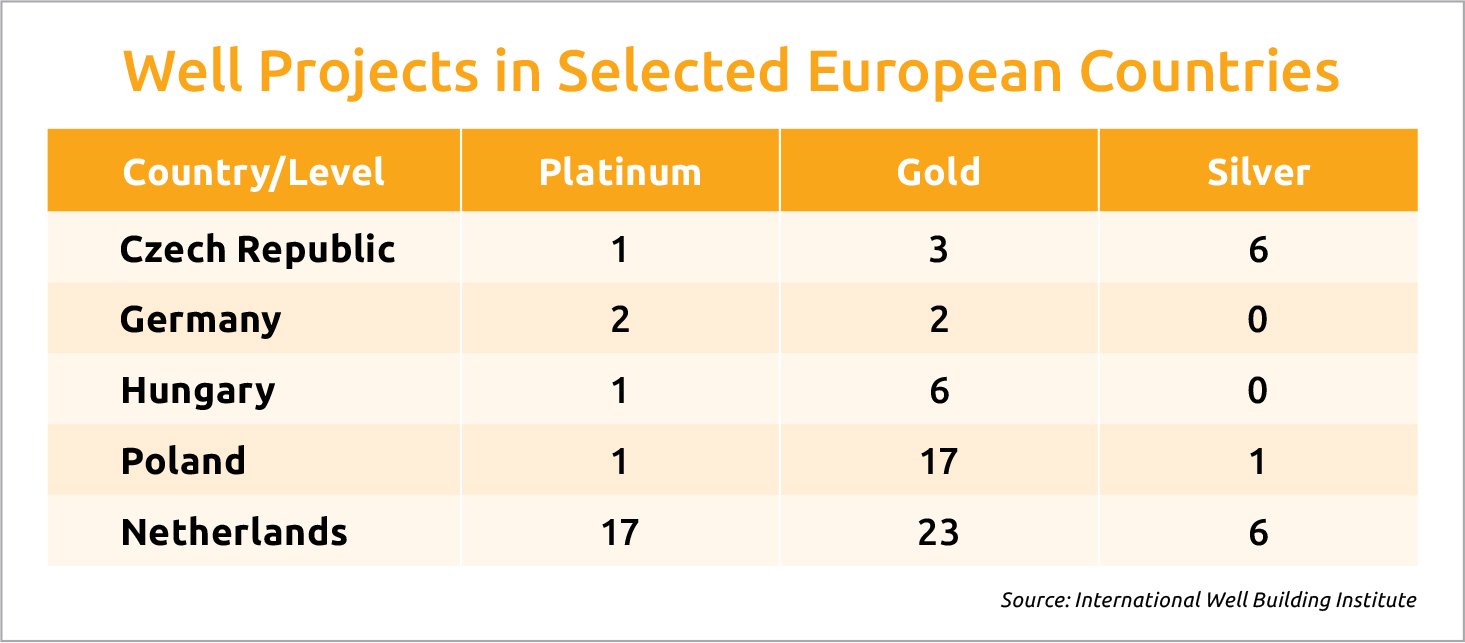

“We are aiming to achieve Well ‘Platinum’ certification for the first time in the city center, and we are the first to obtain a WiredScore rating in Hungary. To comply with sustainability initiatives, we do not create new buildings from the ground but focus on value-added developments of existing buildings that require refurbishment,” he adds.

“Investors are definitely exploring a lot of the sustainability efforts of an investment product; therefore, I would say these will soon apply to all investment deals in addition to institutional acquisitions. We are not aware of green clauses showing up in SPAs [sales and purchase agreements] yet, but the due diligence reports certainly include ample details on sustainability features,” concludes Atenor’s Galambos.

This article was first published in the Budapest Business Journal print issue of September 8, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.